- Canada

- /

- Other Utilities

- /

- TSX:ACO.X

Is It Smart To Buy ATCO Ltd. (TSE:ACO.X) Before It Goes Ex-Dividend?

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see ATCO Ltd. (TSE:ACO.X) is about to trade ex-dividend in the next 4 days. You can purchase shares before the 3rd of June in order to receive the dividend, which the company will pay on the 30th of June.

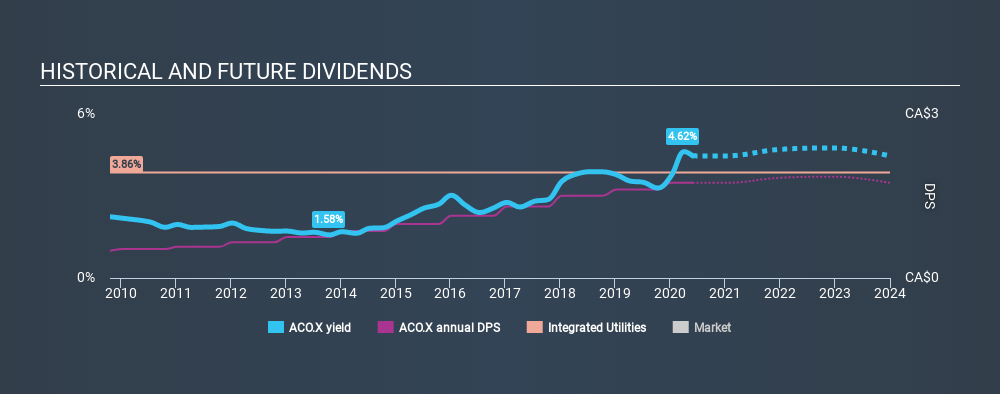

ATCO's next dividend payment will be CA$0.44 per share, and in the last 12 months, the company paid a total of CA$1.74 per share. Calculating the last year's worth of payments shows that ATCO has a trailing yield of 4.5% on the current share price of CA$38.96. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for ATCO

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. That's why it's good to see ATCO paying out a modest 39% of its earnings. A useful secondary check can be to evaluate whether ATCO generated enough free cash flow to afford its dividend. Fortunately, it paid out only 38% of its free cash flow in the past year.

It's positive to see that ATCO's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're encouraged by the steady growth at ATCO, with earnings per share up 3.1% on average over the last five years. Earnings per share growth in recent times has not been a standout. However, companies that see their growth slow can often choose to pay out a greater percentage of earnings to shareholders, which could see the dividend continue to rise.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. ATCO has delivered 13% dividend growth per year on average over the past ten years. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

Final Takeaway

Is ATCO an attractive dividend stock, or better left on the shelf? Earnings per share have been growing moderately, and ATCO is paying out less than half its earnings and cash flow as dividends, which is an attractive combination as it suggests the company is investing in growth. It might be nice to see earnings growing faster, but ATCO is being conservative with its dividend payouts and could still perform reasonably over the long run. ATCO looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

On that note, you'll want to research what risks ATCO is facing. Be aware that ATCO is showing 3 warning signs in our investment analysis, and 1 of those doesn't sit too well with us...

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSX:ACO.X

ATCO

Engages in the energy, logistics and transportation, shelter, and real estate services in Canada, Australia, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives