- United States

- /

- Building

- /

- NasdaqGS:AAON

How Much is AAON, Inc.'s (NASDAQ:AAON) CEO Getting Paid?

In 1989 Norm Asbjornson was appointed CEO of AAON, Inc. (NASDAQ:AAON). First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for AAON

How Does Norm Asbjornson's Compensation Compare With Similar Sized Companies?

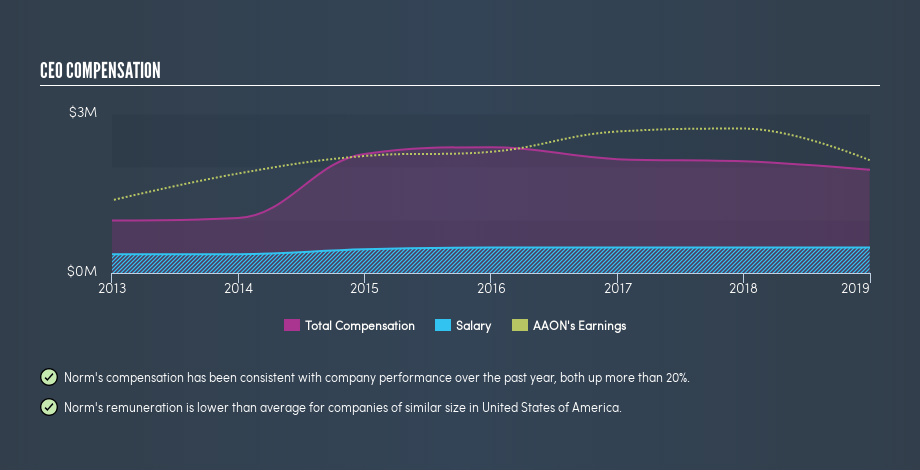

Our data indicates that AAON, Inc. is worth US$2.4b, and total annual CEO compensation is US$1.9m. (This figure is for the year to December 2018). While we always look at total compensation first, we note that the salary component is less, at US$481k. We examined companies with market caps from US$1.0b to US$3.2b, and discovered that the median CEO total compensation of that group was US$4.1m.

Most shareholders would consider it a positive that Norm Asbjornson takes less total compensation than the CEOs of most similar size companies, leaving more for shareholders. However, before we heap on the praise, we should delve deeper to understand business performance.

The graphic below shows how CEO compensation at AAON has changed from year to year.

Is AAON, Inc. Growing?

Over the last three years AAON, Inc. has shrunk its earnings per share by an average of 4.2% per year (measured with a line of best fit). Its revenue is up 7.5% over last year.

Unfortunately, earnings per share have trended lower over the last three years. And the modest revenue growth over 12 months isn't much comfort against the reduced earnings per share. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration.

Has AAON, Inc. Been A Good Investment?

Boasting a total shareholder return of 69% over three years, AAON, Inc. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

It looks like AAON, Inc. pays its CEO less than similar sized companies.

Norm Asbjornson receives relatively low remuneration compared to similar sized companies. And while the company isn't growing earnings per share, total returns have been pleasing. So, while it would be nice to have EPS growth, on our analysis the CEO compensation is not an issue. Shareholders may want to check for free if AAON insiders are buying or selling shares.

If you want to buy a stock that is better than AAON, this free list of high return, low debt companies is a great place to look.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:AAON

AAON

Engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Superintelligence Pivot: Meta’s $135 Billion Bet on the Energy-Compute Nexus

The Privacy Fortress: Apple’s Lean AI Path and the $100 Billion Buyback Engine

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.