As global markets grapple with renewed tariffs, trade policy uncertainties, and weaker economic data, investors are navigating a landscape marked by fluctuating indices and shifting monetary policies. With the U.S. stock indexes experiencing notable declines and geopolitical tensions influencing market sentiment worldwide, identifying undervalued stocks becomes crucial for those seeking potential opportunities amidst volatility. In such an environment, a good stock often demonstrates resilience to external pressures and possesses strong fundamentals that may offer value despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥155.51 | CN¥309.32 | 49.7% |

| Sparebank 68° Nord (OB:SB68) | NOK176.50 | NOK352.99 | 50% |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥22.88 | CN¥45.71 | 49.9% |

| Nanya Technology (TWSE:2408) | NT$43.75 | NT$87.37 | 49.9% |

| Nan Ya Printed Circuit Board (TWSE:8046) | NT$176.50 | NT$350.50 | 49.6% |

| Japan Eyewear Holdings (TSE:5889) | ¥2091.00 | ¥4178.52 | 50% |

| Ion Beam Applications (ENXTBR:IBAB) | €11.68 | €23.34 | 50% |

| Insource (TSE:6200) | ¥927.00 | ¥1843.57 | 49.7% |

| Elan (TSE:6099) | ¥851.00 | ¥1696.20 | 49.8% |

| Allied Machinery (SHSE:605060) | CN¥23.72 | CN¥47.20 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

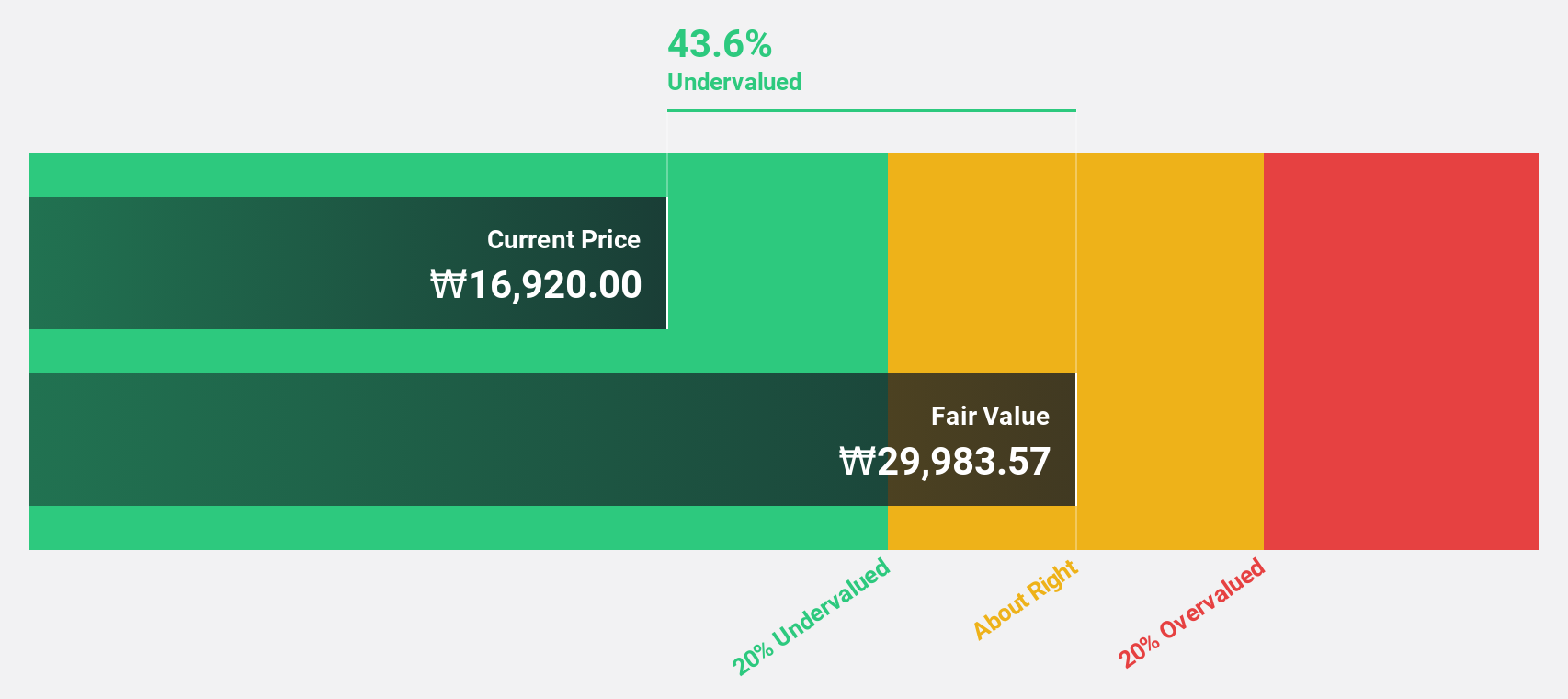

Lotte Tour Development (KOSE:A032350)

Overview: Lotte Tour Development Co., Ltd., along with its subsidiaries, provides travel and tourism services in South Korea and has a market cap of ₩1.35 trillion.

Operations: Lotte Tour Development's revenue is primarily derived from the Dream Tower Integrated Resort Division, which accounts for ₩396.33 billion, followed by the Travel Related Service Sector (excluding Internet Journalism) at ₩88.05 billion, and the Internet Media Sector contributing ₩2.80 billion.

Estimated Discount To Fair Value: 40.5%

Lotte Tour Development is trading at ₩18,090, significantly below its estimated fair value of ₩30,393.83, presenting a potential opportunity for investors focused on undervalued stocks based on cash flows. Despite its revenue growth forecast of 14.3% per year being slower than 20%, it surpasses the Korean market average of 7.1%. However, with a low projected return on equity of 8.1%, cautious consideration is advised regarding long-term profitability prospects.

- The analysis detailed in our Lotte Tour Development growth report hints at robust future financial performance.

- Navigate through the intricacies of Lotte Tour Development with our comprehensive financial health report here.

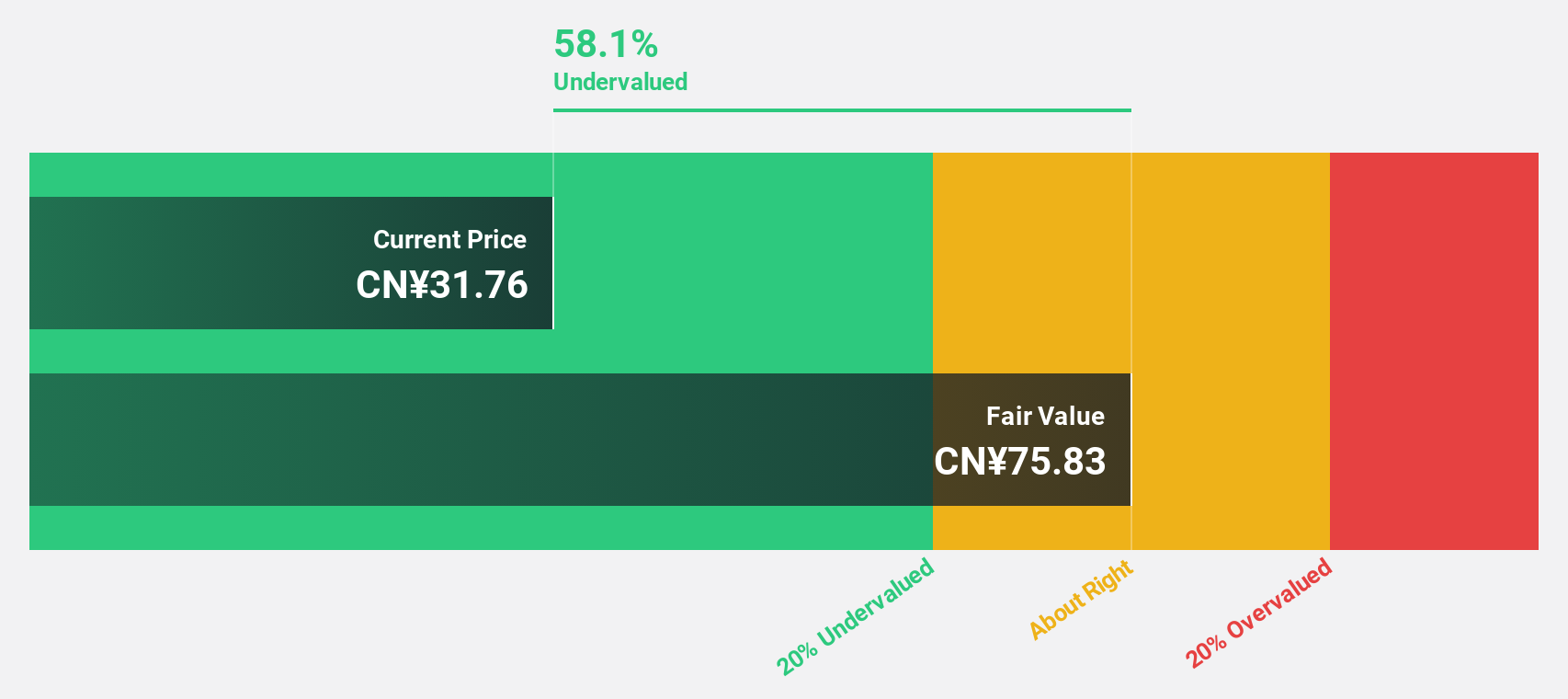

Nancal TechnologyLtd (SHSE:603859)

Overview: Nancal Technology Co., Ltd offers digital transformation solutions both in China and internationally, with a market cap of CN¥9.47 billion.

Operations: Nancal Technology Co., Ltd generates its revenue through providing digital transformation solutions across various regions, including China and international markets.

Estimated Discount To Fair Value: 44.8%

Nancal Technology Ltd. is trading at CN¥42.61, significantly below its estimated fair value of CN¥77.17, indicating potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 23.8% annually over the next three years, outpacing the Chinese market's average growth rate of 23.6%. However, with a forecasted return on equity of only 9% in three years, investors should weigh long-term profitability concerns carefully. Recent share buybacks may also influence valuation positively.

- According our earnings growth report, there's an indication that Nancal TechnologyLtd might be ready to expand.

- Get an in-depth perspective on Nancal TechnologyLtd's balance sheet by reading our health report here.

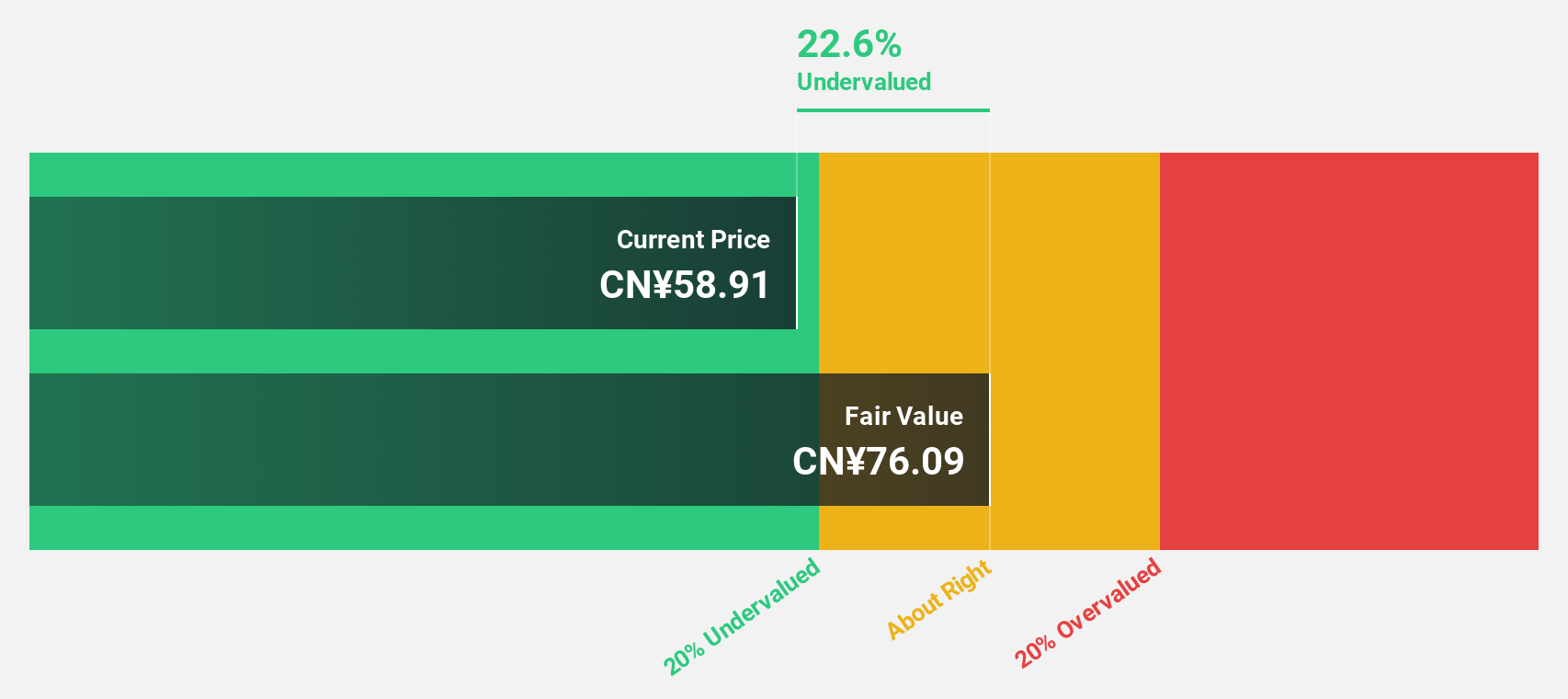

Ninebot (SHSE:689009)

Overview: Ninebot Limited is involved in the design, research and development, production, sale, and servicing of transportation and robot products globally, with a market cap of CN¥42.05 billion.

Operations: Ninebot Limited's revenue segments include the design, R&D, production, sale, and servicing of transportation and robot products on a global scale.

Estimated Discount To Fair Value: 20%

Ninebot Limited's current trading price of CN¥60.98 positions it below the estimated fair value of CN¥76.24, suggesting potential undervaluation based on cash flows. The company's earnings are forecast to grow at a robust 27% annually, outpacing the broader Chinese market growth rate of 23.6%. With revenue expected to increase by over 20% per year and analysts projecting a 24% stock price rise, Ninebot presents a compelling case for growth-oriented investors.

- The growth report we've compiled suggests that Ninebot's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Ninebot.

Key Takeaways

- Gain an insight into the universe of 493 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ninebot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:689009

Ninebot

Engages in the design, research and development, production, sale, and servicing of transportation and robot products worldwide.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives