- United States

- /

- Banks

- /

- OTCPK:BCTF

Does Bancorp 34, Inc. (NASDAQ:BCTF) Have A Good P/E Ratio?

To the annoyance of some shareholders, Bancorp 34 (NASDAQ:BCTF) shares are down a considerable in the last month. Indeed, the recent drop has reduced the annual gain to a relatively sedate 3.0% over the last twelve months.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. The implication here is that deep value investors might steer clear when expectations of a company are too high. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

See our latest analysis for Bancorp 34

How Does Bancorp 34's P/E Ratio Compare To Its Peers?

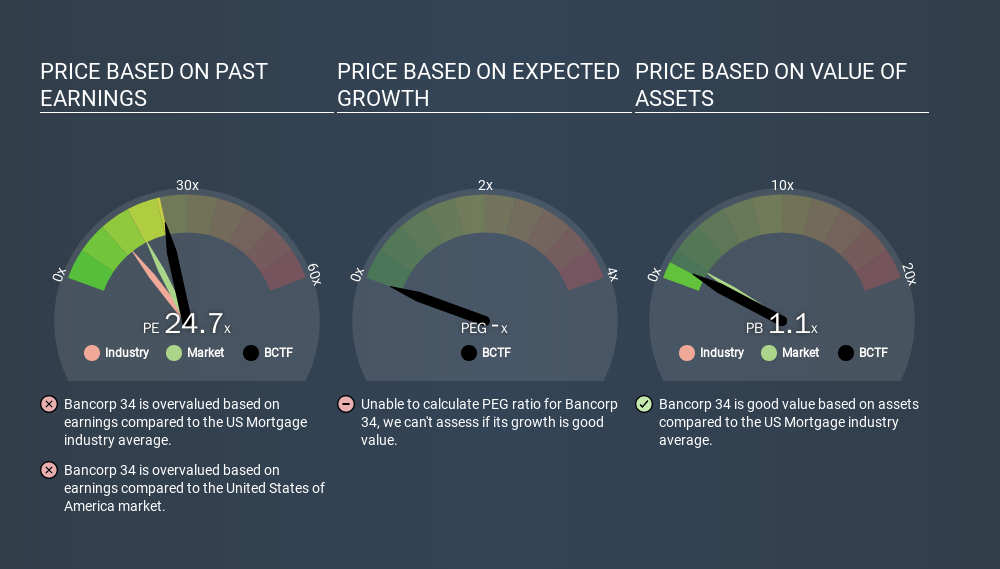

We can tell from its P/E ratio of 24.67 that there is some investor optimism about Bancorp 34. You can see in the image below that the average P/E (13.6) for companies in the mortgage industry is lower than Bancorp 34's P/E.

That means that the market expects Bancorp 34 will outperform other companies in its industry. The market is optimistic about the future, but that doesn't guarantee future growth. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

If earnings fall then in the future the 'E' will be lower. That means unless the share price falls, the P/E will increase in a few years. Then, a higher P/E might scare off shareholders, pushing the share price down.

Bancorp 34's 92% EPS improvement over the last year was like bamboo growth after rain; rapid and impressive. The sweetener is that the annual five year growth rate of 23% is also impressive. With that kind of growth rate we would generally expect a high P/E ratio. Regrettably, the longer term performance is poor, with EPS down -23% per year over 3 years.

Remember: P/E Ratios Don't Consider The Balance Sheet

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. So it won't reflect the advantage of cash, or disadvantage of debt. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Bancorp 34's Balance Sheet

Net debt totals 23% of Bancorp 34's market cap. That's enough debt to impact the P/E ratio a little; so keep it in mind if you're comparing it to companies without debt.

The Bottom Line On Bancorp 34's P/E Ratio

Bancorp 34 has a P/E of 24.7. That's higher than the average in its market, which is 18.2. While the company does use modest debt, its recent earnings growth is superb. So to be frank we are not surprised it has a high P/E ratio. Given Bancorp 34's P/E ratio has declined from 24.7 to 24.7 in the last month, we know for sure that the market is less confident about the business today, than it was back then. For those who prefer to invest with the flow of momentum, that might be a bad sign, but for a contrarian, it may signal opportunity.

When the market is wrong about a stock, it gives savvy investors an opportunity. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course you might be able to find a better stock than Bancorp 34. So you may wish to see this free collection of other companies that have grown earnings strongly.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OTCPK:BCTF

Bancorp 34

Operates as the holding company for Southwest Heritage Bank that offers various banking products and services to individuals and businesses in the United States.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

The Silver Squeeze Premium: Hecla’s High-Stakes Balancing Act

Sogeclair's Outlook Will See a 18x Future PE in Five Years

The Grid Modernizer: Leidos and the $2.4 Billion Bet on Sovereign AI and Energy

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.