- United States

- /

- Beverage

- /

- NasdaqGS:FIZZ

Can National Beverage Corp. (NASDAQ:FIZZ) Maintain Its Strong Returns?

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. We'll use ROE to examine National Beverage Corp. (NASDAQ:FIZZ), by way of a worked example.

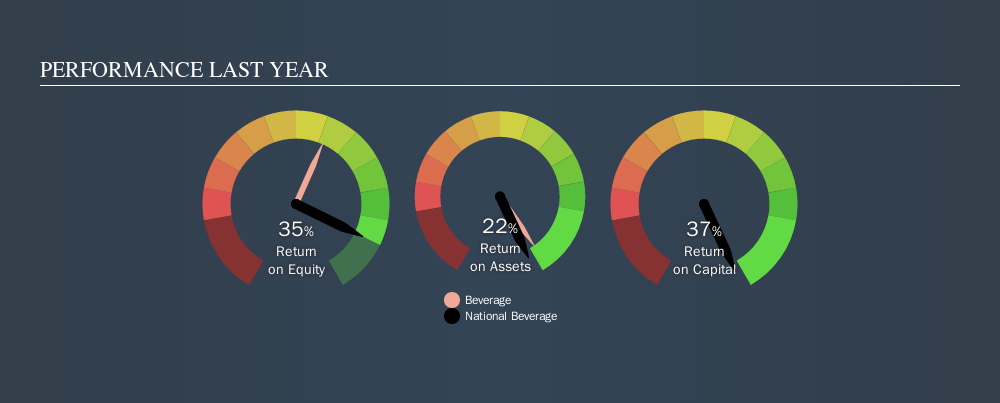

Our data shows National Beverage has a return on equity of 35% for the last year. That means that for every $1 worth of shareholders' equity, it generated $0.35 in profit.

See our latest analysis for National Beverage

How Do You Calculate ROE?

The formula for ROE is:

Return on Equity = Net Profit ÷ Shareholders' Equity

Or for National Beverage:

35% = US$127m ÷ US$366m (Based on the trailing twelve months to July 2019.)

It's easy to understand the 'net profit' part of that equation, but 'shareholders' equity' requires further explanation. It is the capital paid in by shareholders, plus any retained earnings. Shareholders' equity can be calculated by subtracting the total liabilities of the company from the total assets of the company.

What Does Return On Equity Signify?

ROE looks at the amount a company earns relative to the money it has kept within the business. The 'return' is the yearly profit. A higher profit will lead to a higher ROE. So, all else being equal, a high ROE is better than a low one. That means it can be interesting to compare the ROE of different companies.

Does National Beverage Have A Good Return On Equity?

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. As you can see in the graphic below, National Beverage has a higher ROE than the average (20%) in the Beverage industry.

That's clearly a positive. I usually take a closer look when a company has a better ROE than industry peers. For example, I often check if insiders have been buying shares .

The Importance Of Debt To Return On Equity

Most companies need money -- from somewhere -- to grow their profits. That cash can come from issuing shares, retained earnings, or debt. In the first and second cases, the ROE will reflect this use of cash for investment in the business. In the latter case, the debt used for growth will improve returns, but won't affect the total equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

Combining National Beverage's Debt And Its 35% Return On Equity

One positive for shareholders is that National Beverage does not have any net debt! Its impressive ROE suggests it is a high quality business, but it's even better to have achieved that without leverage. At the end of the day, when a company has zero debt, it is in a better position to take future growth opportunities.

In Summary

Return on equity is useful for comparing the quality of different businesses. A company that can achieve a high return on equity without debt could be considered a high quality business. If two companies have around the same level of debt to equity, and one has a higher ROE, I'd generally prefer the one with higher ROE.

But when a business is high quality, the market often bids it up to a price that reflects this. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. So you might want to take a peek at this data-rich interactive graph of forecasts for the company.

Of course National Beverage may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:FIZZ

National Beverage

Through its subsidiaries, develops, produces, markets, and sells a portfolio of sparkling waters, juices, energy drinks, and carbonated soft drinks in the United States and Canada.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.