Asian Market Gems: Cowell e Holdings And 2 More Stocks That May Be Priced Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate through a landscape marked by potential rate cuts and fluctuating investor sentiment, Asian markets have shown resilience with notable gains in key indices. In this environment, identifying stocks that may be undervalued can present opportunities for investors seeking to capitalize on price discrepancies relative to intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥84.02 | CN¥165.09 | 49.1% |

| Wanguo Gold Group (SEHK:3939) | HK$29.72 | HK$58.47 | 49.2% |

| Unimicron Technology (TWSE:3037) | NT$142.00 | NT$277.09 | 48.8% |

| TOWA (TSE:6315) | ¥1666.00 | ¥3329.60 | 50% |

| Takara Bio (TSE:4974) | ¥933.00 | ¥1829.46 | 49% |

| Sunjin Beauty ScienceLtd (KOSDAQ:A086710) | ₩10750.00 | ₩21023.92 | 48.9% |

| SRE Holdings (TSE:2980) | ¥3330.00 | ¥6612.15 | 49.6% |

| Matsuya R&DLtd (TSE:7317) | ¥732.00 | ¥1428.71 | 48.8% |

| Lum Chang Creations (Catalist:LCC) | SGD0.55 | SGD1.08 | 49.2% |

| Cosmax (KOSE:A192820) | ₩217000.00 | ₩424304.90 | 48.9% |

We're going to check out a few of the best picks from our screener tool.

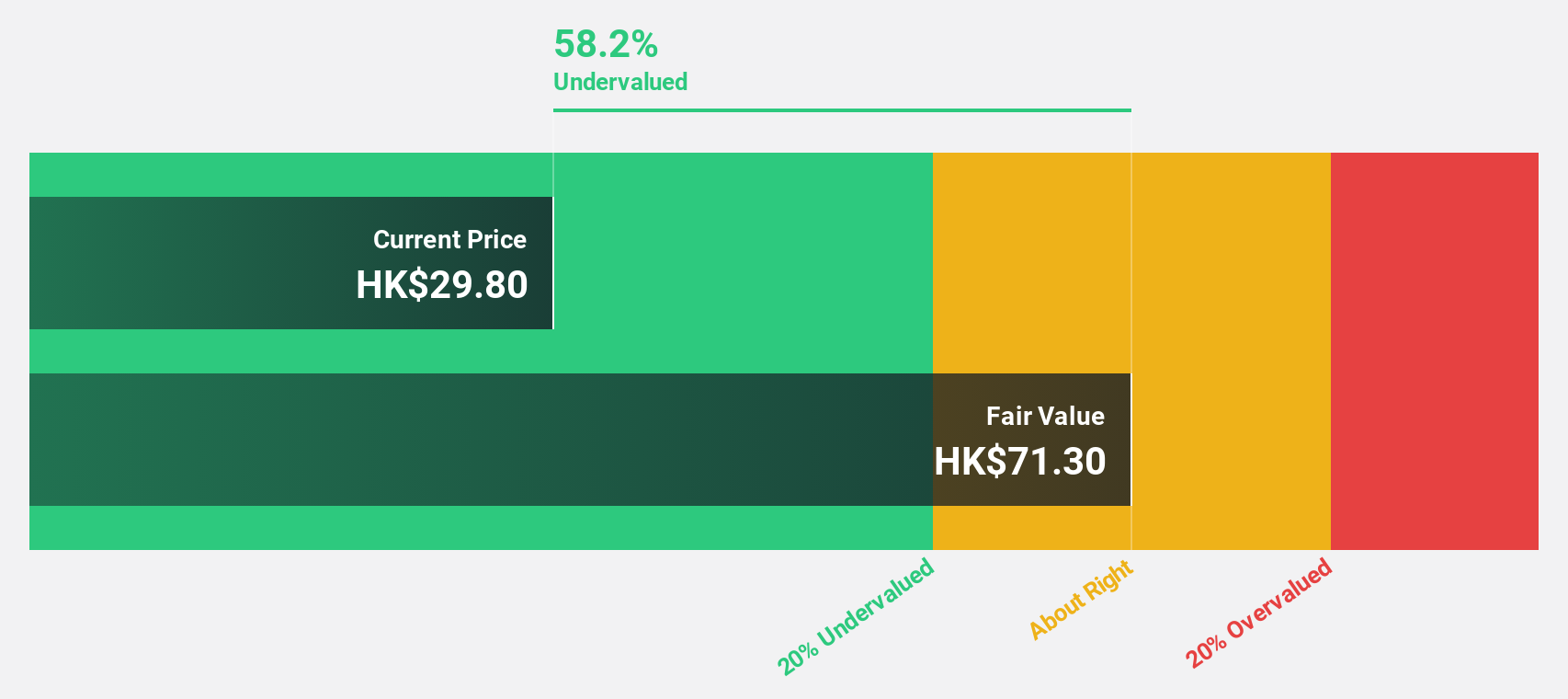

Cowell e Holdings (SEHK:1415)

Overview: Cowell e Holdings Inc. is an investment holding company involved in the design, development, manufacture and sale of modules and system integration products for smartphones, multimedia tablets and other mobile devices, with a market cap of HK$28.83 billion.

Operations: The company generates revenue primarily from its Photographic Equipment & Supplies segment, amounting to $3.27 billion.

Estimated Discount To Fair Value: 39.1%

Cowell e Holdings is trading at HK$33.38, significantly below its estimated fair value of HK$54.77, indicating it may be undervalued based on cash flows. The company's revenue and earnings are expected to grow faster than the Hong Kong market, with earnings forecasted to rise by 21.5% annually over the next three years. Recent half-year results showed sales of US$1.36 billion and net income of US$67.4 million, reflecting robust financial performance year-over-year.

- Our expertly prepared growth report on Cowell e Holdings implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Cowell e Holdings.

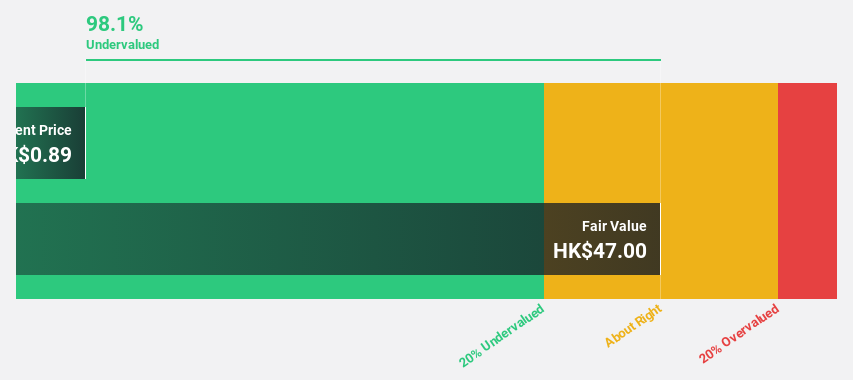

Lingbao Gold Group (SEHK:3330)

Overview: Lingbao Gold Group Company Ltd. is involved in the mining, processing, smelting, refining, and sale of gold products in China, with a market cap of HK$16.20 billion.

Operations: The company's revenue segments consist of Smelting (CN¥12.04 billion), Mining in the People's Republic of China (CN¥2.31 billion), Mining in the Kyrgyz Republic (CN¥257.32 million), and Retailing (CN¥8.53 million).

Estimated Discount To Fair Value: 20.6%

Lingbao Gold Group is trading at HK$12.59, over 20% below its estimated fair value of HK$15.86, highlighting potential undervaluation based on cash flows. The company reported a significant increase in half-year sales to CNY 7.79 billion and net income to CNY 663.97 million, driven by enhanced gold production and cost control measures amid rising market prices. Earnings are projected to grow significantly faster than the Hong Kong market at an annual rate of 26%.

- In light of our recent growth report, it seems possible that Lingbao Gold Group's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Lingbao Gold Group.

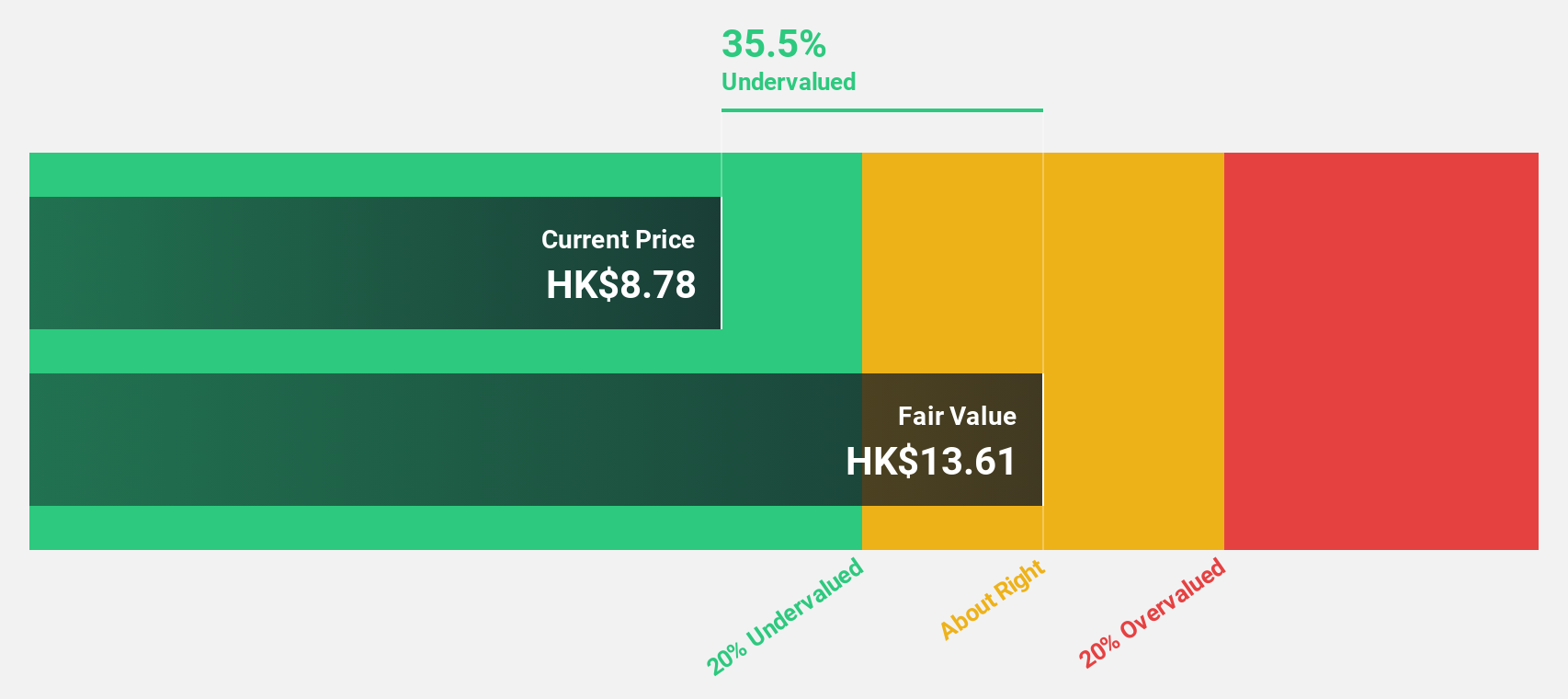

Dongfeng Motor Group (SEHK:489)

Overview: Dongfeng Motor Group Company Limited focuses on the research, development, manufacture, and sale of commercial and passenger vehicles, engines, and auto parts in China with a market cap of approximately HK$75.10 billion.

Operations: The company's revenue segments include CN¥56.02 billion from passenger vehicles, CN¥46.96 billion from commercial vehicles, and CN¥5.61 billion from financing services.

Estimated Discount To Fair Value: 32.9%

Dongfeng Motor Group is trading at HK$9.1, significantly below its estimated fair value of HK$13.57, suggesting notable undervaluation based on cash flows. Despite a decline in net income to CNY 55 million for the first half of 2025, earnings are forecasted to grow substantially by 77.24% annually over the next three years as profitability improves. Recent strategic moves include a joint venture with Nissan and an acquisition agreement valued at HKD 14.4 billion, potentially enhancing future growth prospects despite current challenges in non-luxury segments.

- Our growth report here indicates Dongfeng Motor Group may be poised for an improving outlook.

- Click here to discover the nuances of Dongfeng Motor Group with our detailed financial health report.

Key Takeaways

- Click here to access our complete index of 272 Undervalued Asian Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:489

Dongfeng Motor Group

Engages in the research, development, manufacture, and sale of commercial and passenger vehicles, engines, and other auto parts in the People’s Republic of China.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives