Stock Analysis

Yuanda China Holdings Limited's (HKG:2789) 26% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/ERatio

Yuanda China Holdings Limited (HKG:2789) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Longer-term shareholders would now have taken a real hit with the stock declining 7.5% in the last year.

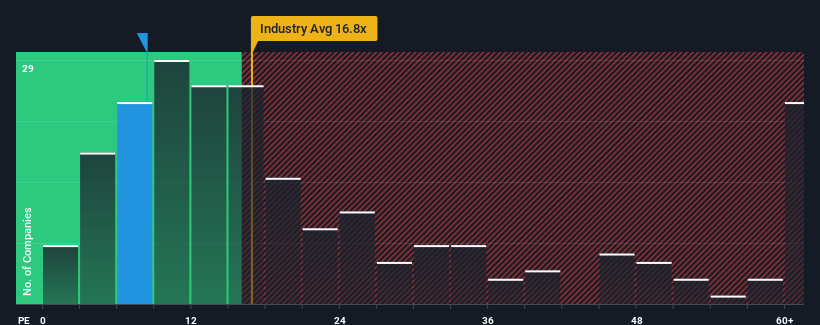

Although its price has dipped substantially, there still wouldn't be many who think Yuanda China Holdings' price-to-earnings (or "P/E") ratio of 8.4x is worth a mention when the median P/E in Hong Kong is similar at about 9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

As an illustration, earnings have deteriorated at Yuanda China Holdings over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Yuanda China Holdings

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Yuanda China Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 65% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Yuanda China Holdings' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

Yuanda China Holdings' plummeting stock price has brought its P/E right back to the rest of the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Yuanda China Holdings revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Yuanda China Holdings has 5 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Yuanda China Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Yuanda China Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2789

Yuanda China Holdings

Yuanda China Holdings Limited, an investment holding company, engages in the design, procurement, production, assembling, sale, and installation of curtain wall systems in Mainland China, the United States, the United Kingdom, Australia, and internationally.

Good value with mediocre balance sheet.