Stock Analysis

- Malaysia

- /

- Construction

- /

- KLSE:SSB8

With EPS Growth And More, Southern Score Builders Berhad (KLSE:SSB8) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Southern Score Builders Berhad (KLSE:SSB8), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Southern Score Builders Berhad

Southern Score Builders Berhad's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. To the delight of shareholders, Southern Score Builders Berhad's EPS soared from RM0.01 to RM0.014, over the last year. That's a impressive gain of 34%.

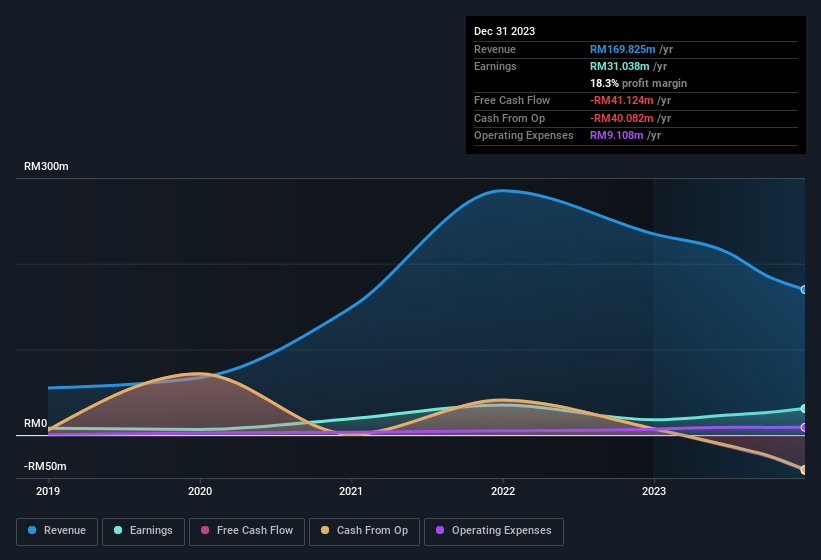

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. We note that while EBIT margins have improved from 12% to 27%, the company has actually reported a fall in revenue by 28%. That's not a good look.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Southern Score Builders Berhad isn't a huge company, given its market capitalisation of RM864m. That makes it extra important to check on its balance sheet strength.

Are Southern Score Builders Berhad Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Southern Score Builders Berhad insiders have a significant amount of capital invested in the stock. To be specific, they have RM218m worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 25% of the company; visible skin in the game.

Should You Add Southern Score Builders Berhad To Your Watchlist?

You can't deny that Southern Score Builders Berhad has grown its earnings per share at a very impressive rate. That's attractive. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Southern Score Builders Berhad (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

Although Southern Score Builders Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Malaysian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Southern Score Builders Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SSB8

Southern Score Builders Berhad

Southern Score Builders Berhad provides construction management services for building and infrastructure works in Malaysia.

Excellent balance sheet with proven track record.