Stock Analysis

- United States

- /

- Auto

- /

- NasdaqGS:VFS

Why We're Not Concerned Yet About VinFast Auto Ltd.'s (NASDAQ:VFS) 35% Share Price Plunge

Unfortunately for some shareholders, the VinFast Auto Ltd. (NASDAQ:VFS) share price has dived 35% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 68% share price decline.

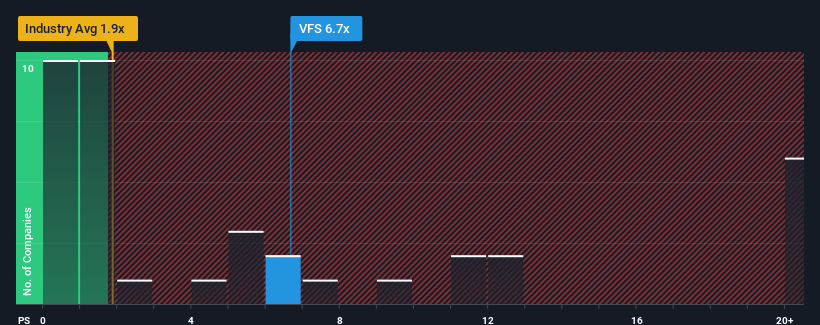

Even after such a large drop in price, given around half the companies in the United States' Auto industry have price-to-sales ratios (or "P/S") below 1.9x, you may still consider VinFast Auto as a stock to avoid entirely with its 6.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for VinFast Auto

How Has VinFast Auto Performed Recently?

VinFast Auto certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on VinFast Auto.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as VinFast Auto's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 92% last year. The latest three year period has also seen an excellent 110% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 83% per year over the next three years. With the industry only predicted to deliver 20% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why VinFast Auto's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

VinFast Auto's shares may have suffered, but its P/S remains high. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of VinFast Auto's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 4 warning signs for VinFast Auto (3 are potentially serious!) that you need to take into consideration.

If you're unsure about the strength of VinFast Auto's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether VinFast Auto is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NasdaqGS:VFS

VinFast Auto

VinFast Auto Ltd. engages in the design and manufacture of electric vehicles (EV), e-scooters, and e-buses in Vietnam, Canada, and the United States.

Limited growth with weak fundamentals.