- United States

- /

- Insurance

- /

- NasdaqGS:GSHD

Why Investors Shouldn't Be Surprised By Goosehead Insurance, Inc's (NASDAQ:GSHD) 53% Share Price Surge

The Goosehead Insurance, Inc (NASDAQ:GSHD) share price has done very well over the last month, posting an excellent gain of 53%. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

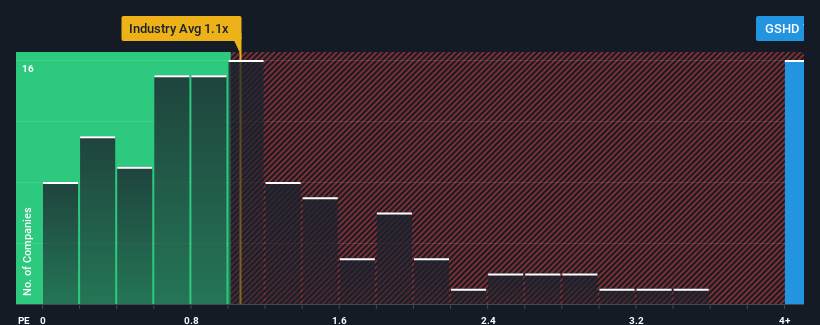

After such a large jump in price, when almost half of the companies in the United States' Insurance industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Goosehead Insurance as a stock not worth researching with its 7.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Goosehead Insurance

How Goosehead Insurance Has Been Performing

Goosehead Insurance's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Goosehead Insurance will help you uncover what's on the horizon.How Is Goosehead Insurance's Revenue Growth Trending?

Goosehead Insurance's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. Pleasingly, revenue has also lifted 104% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 23% over the next year. With the industry only predicted to deliver 4.7%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Goosehead Insurance's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Goosehead Insurance have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Goosehead Insurance shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Goosehead Insurance (1 shouldn't be ignored!) that we have uncovered.

If these risks are making you reconsider your opinion on Goosehead Insurance, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSHD

Goosehead Insurance

Operates as a holding company for Goosehead Financial, LLC that engages in the provision of personal lines insurance agency services in the United States.

Exceptional growth potential with solid track record.