Stock Analysis

- South Korea

- /

- Pharma

- /

- KOSDAQ:A000250

While shareholders of Sam Chun Dang Pharm (KOSDAQ:000250) are in the black over 5 years, those who bought a week ago aren't so fortunate

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on a lighter note, a good company can see its share price rise well over 100%. For example, the Sam Chun Dang Pharm. Co., Ltd (KOSDAQ:000250) share price has soared 107% in the last half decade. Most would be very happy with that. It's also good to see the share price up 33% over the last quarter.

Since the long term performance has been good but there's been a recent pullback of 8.9%, let's check if the fundamentals match the share price.

Check out our latest analysis for Sam Chun Dang Pharm

Sam Chun Dang Pharm wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Sam Chun Dang Pharm saw its revenue grow at 1.4% per year. That's not a very high growth rate considering the bottom line. So we wouldn't have expected to see the share price to have lifted 16% for each year during that time, but that's what happened. While we wouldn't be overly concerned, it might be worth checking whether you think the fundamental business gains really justify the share price action. It may be that the market is pretty optimistic about Sam Chun Dang Pharm.

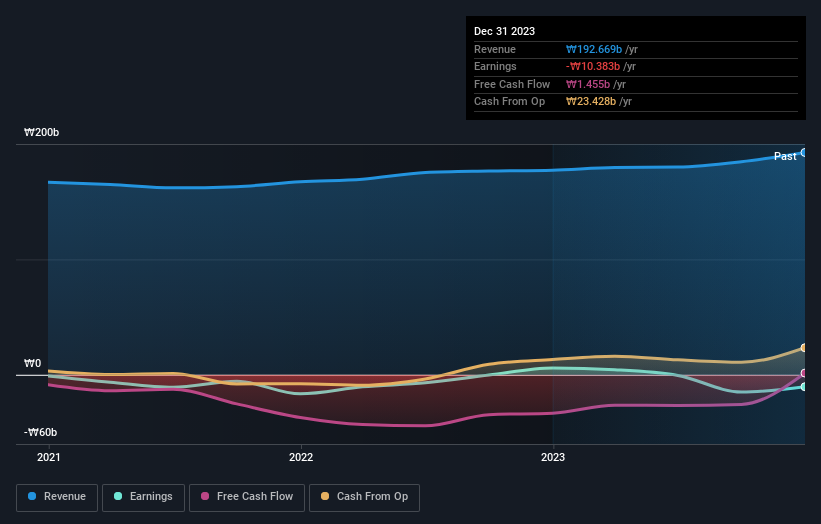

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Sam Chun Dang Pharm shareholders gained a total return of 1.3% during the year. But that was short of the market average. On the bright side, the longer term returns (running at about 16% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Sam Chun Dang Pharm you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Sam Chun Dang Pharm is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A000250

Sam Chun Dang Pharm

Sam Chun Dang Pharm. Co., Ltd engages in the manufacturing and sale of pharmaceutical products in South Korea.

Excellent balance sheet with weak fundamentals.