Stock Analysis

- India

- /

- Professional Services

- /

- NSEI:BLS

What You Can Learn From BLS International Services Limited's (NSE:BLS) P/E

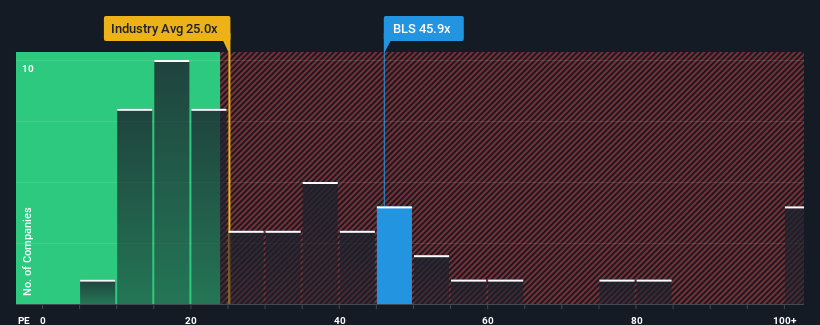

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 31x, you may consider BLS International Services Limited (NSE:BLS) as a stock to potentially avoid with its 45.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

BLS International Services certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for BLS International Services

How Is BLS International Services' Growth Trending?

BLS International Services' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 80% last year. Pleasingly, EPS has also lifted 736% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 24% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we can see why BLS International Services is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that BLS International Services maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for BLS International Services with six simple checks.

If these risks are making you reconsider your opinion on BLS International Services, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether BLS International Services is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BLS

BLS International Services

BLS International Services Limited provides outsourcing and administrative task of visa, passport, and consular services to various diplomatic missions.

Outstanding track record with flawless balance sheet.