Stock Analysis

Borgestad ASA (OB:BOR) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 75% share price drop in the last twelve months.

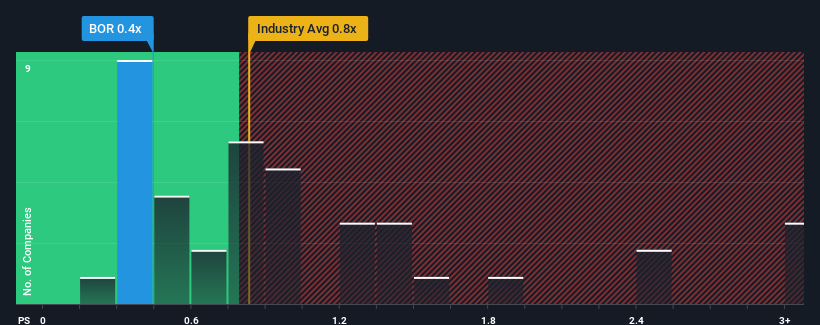

Even after such a large jump in price, there still wouldn't be many who think Borgestad's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Norway's Basic Materials industry is similar at about 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Borgestad

How Has Borgestad Performed Recently?

Recent times have been pleasing for Borgestad as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. Those who are bullish on Borgestad will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Borgestad.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Borgestad's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. The strong recent performance means it was also able to grow revenue by 36% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 2.4% per annum during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 5.3% per year, which is noticeably more attractive.

In light of this, it's curious that Borgestad's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Borgestad's P/S

Borgestad's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Borgestad's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Borgestad (1 shouldn't be ignored) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Borgestad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:BOR

Borgestad

Borgestad ASA develops, manufactures, distributes, and installs refractory products in Norway.

Flawless balance sheet and undervalued.