Stock Analysis

- Bulgaria

- /

- Medical Equipment

- /

- BUL:ETR

We Think Etropal AD (BUL:ETR) Can Stay On Top Of Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Etropal AD (BUL:ETR) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Etropal AD

What Is Etropal AD's Net Debt?

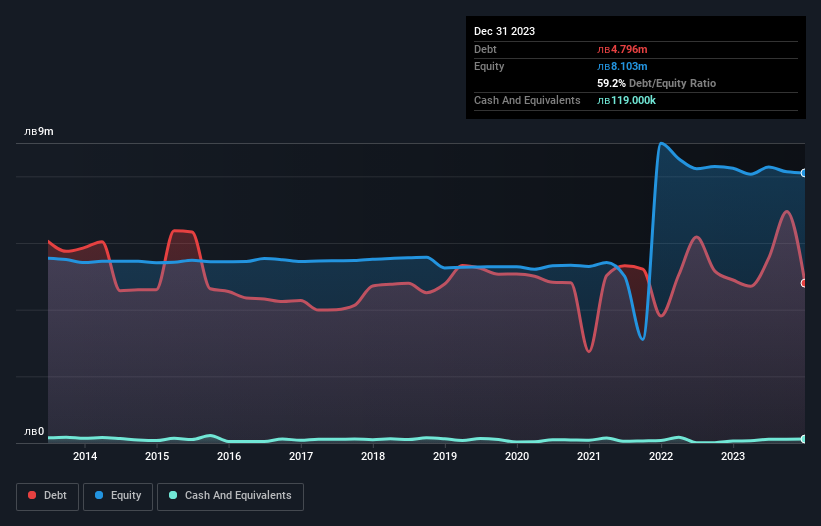

As you can see below, Etropal AD had лв4.80m of debt, at December 2023, which is about the same as the year before. You can click the chart for greater detail. However, it also had лв119.0k in cash, and so its net debt is лв4.68m.

How Strong Is Etropal AD's Balance Sheet?

According to the last reported balance sheet, Etropal AD had liabilities of лв8.93m due within 12 months, and liabilities of лв1.44m due beyond 12 months. On the other hand, it had cash of лв119.0k and лв3.06m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by лв7.19m.

This deficit isn't so bad because Etropal AD is worth лв22.5m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Etropal AD's debt to EBITDA ratio (3.8) suggests that it uses some debt, its interest cover is very weak, at 1.2, suggesting high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. However, the silver lining was that Etropal AD achieved a positive EBIT of лв333k in the last twelve months, an improvement on the prior year's loss. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Etropal AD will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, Etropal AD actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Based on what we've seen Etropal AD is not finding it easy, given its interest cover, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to convert EBIT to free cash flow is pretty flash. It's also worth noting that Etropal AD is in the Medical Equipment industry, which is often considered to be quite defensive. When we consider all the factors mentioned above, we do feel a bit cautious about Etropal AD's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Etropal AD you should be aware of, and 2 of them can't be ignored.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're helping make it simple.

Find out whether Etropal AD is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About BUL:ETR

Etropal AD

Etropal AD engages in the research, development, and manufacture of disposable medical devices for dialysis in Bulgaria.

Acceptable track record with imperfect balance sheet.