Stock Analysis

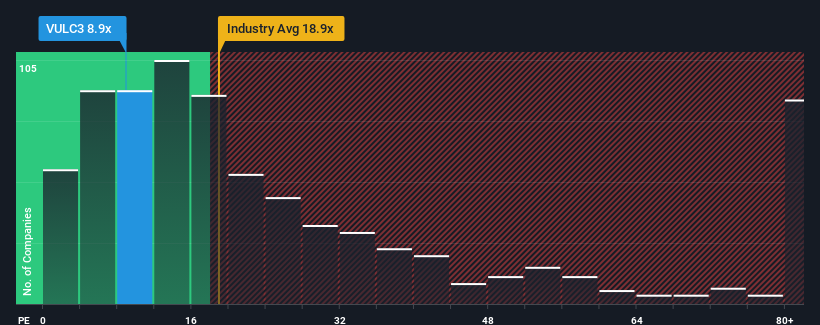

With a median price-to-earnings (or "P/E") ratio of close to 10x in Brazil, you could be forgiven for feeling indifferent about Vulcabras S.A.'s (BVMF:VULC3) P/E ratio of 8.9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Vulcabras could be doing better as it's been growing earnings less than most other companies lately. One possibility is that the P/E is moderate because investors think this lacklustre earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for Vulcabras

Is There Some Growth For Vulcabras?

The only time you'd be comfortable seeing a P/E like Vulcabras' is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 5.5% last year. Pleasingly, EPS has also lifted 1,306% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 19% each year during the coming three years according to the three analysts following the company. With the market only predicted to deliver 16% per year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Vulcabras is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Vulcabras' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Vulcabras is showing 3 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Vulcabras is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About BOVESPA:VULC3

Vulcabras

Vulcabras S.A., through its subsidiaries, operates as a footwear company in Brazil and internationally.

Excellent balance sheet and good value.