Stock Analysis

- Brazil

- /

- Commercial Services

- /

- BOVESPA:ALPK3

Unpleasant Surprises Could Be In Store For Allpark Empreendimentos, Participações e Serviços S.A.'s (BVMF:ALPK3) Shares

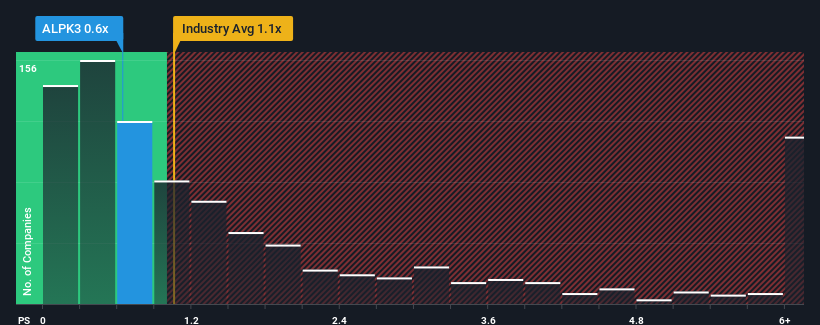

It's not a stretch to say that Allpark Empreendimentos, Participações e Serviços S.A.'s (BVMF:ALPK3) price-to-sales (or "P/S") ratio of 0.6x seems quite "middle-of-the-road" for Commercial Services companies in Brazil, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Allpark Empreendimentos Participações e Serviços

What Does Allpark Empreendimentos Participações e Serviços' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Allpark Empreendimentos Participações e Serviços has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Allpark Empreendimentos Participações e Serviços will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Allpark Empreendimentos Participações e Serviços' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. Pleasingly, revenue has also lifted 109% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 8.6% as estimated by the lone analyst watching the company. That's shaping up to be materially lower than the 27% growth forecast for the broader industry.

In light of this, it's curious that Allpark Empreendimentos Participações e Serviços' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Allpark Empreendimentos Participações e Serviços' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

It is also worth noting that we have found 1 warning sign for Allpark Empreendimentos Participações e Serviços that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Allpark Empreendimentos Participações e Serviços is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About BOVESPA:ALPK3

Allpark Empreendimentos Participações e Serviços

Allpark Empreendimentos, Participações e Serviços S.A.

Good value with imperfect balance sheet.