- United States

- /

- Aerospace & Defense

- /

- NYSE:EVTL

Top Key Executive Stephen Fitzpatrick, Vertical Aerospace Ltd.'s (NYSE:EVTL) largest shareholder sees value of holdings go down 14% after recent drop

Key Insights

- Insiders appear to have a vested interest in Vertical Aerospace's growth, as seen by their sizeable ownership

- 70% of the company is held by a single shareholder (Stephen Fitzpatrick)

- Using data from analyst forecasts alongside ownership research, one can better assess the future performance of a company

If you want to know who really controls Vertical Aerospace Ltd. (NYSE:EVTL), then you'll have to look at the makeup of its share registry. With 70% stake, individual insiders possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

As a result, insiders as a group endured the highest losses after market cap fell by US$29m.

Let's take a closer look to see what the different types of shareholders can tell us about Vertical Aerospace.

View our latest analysis for Vertical Aerospace

What Does The Lack Of Institutional Ownership Tell Us About Vertical Aerospace?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don't attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. Vertical Aerospace might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

Vertical Aerospace is not owned by hedge funds. Because actions speak louder than words, we consider it a good sign when insiders own a significant stake in a company. In Vertical Aerospace's case, its Top Key Executive, Stephen Fitzpatrick, is the largest shareholder, holding 70% of shares outstanding. With 5.1% and 0.2% of the shares outstanding respectively, American Airlines Group Inc. and Millennium Management LLC are the second and third largest shareholders.

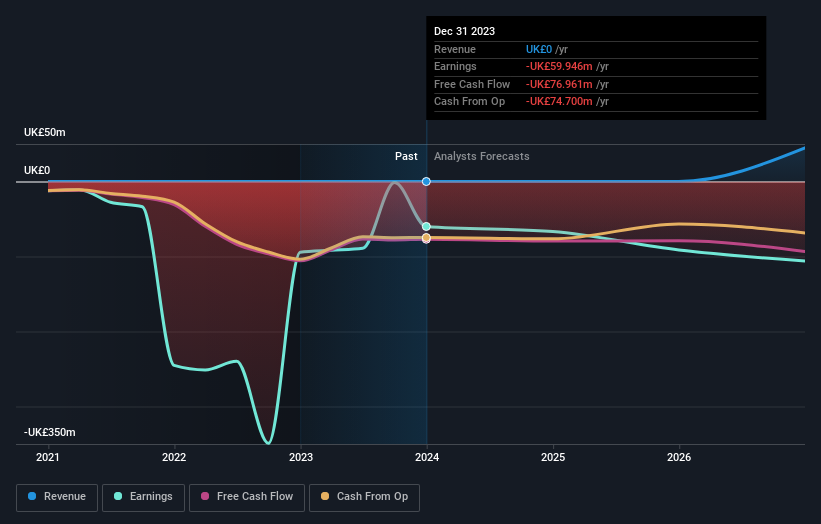

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Vertical Aerospace

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders own more than half of Vertical Aerospace Ltd.. This gives them effective control of the company. So they have a US$122m stake in this US$174m business. Most would be pleased to see the board is investing alongside them. You may wish todiscover (for free) if they have been buying or selling.

General Public Ownership

With a 24% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Vertical Aerospace. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Public Company Ownership

It appears to us that public companies own 5.1% of Vertical Aerospace. We can't be certain but it is quite possible this is a strategic stake. The businesses may be similar, or work together.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Take risks for example - Vertical Aerospace has 5 warning signs (and 3 which are potentially serious) we think you should know about.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EVTL

Vertical Aerospace

An aerospace and technology company, engages in designing, manufacturing, and selling zero operating emission electric vertical takeoff and landing (eVTOL) aircraft for use in the advanced air mobility in the United Kingdom.

Medium-low with worrying balance sheet.