Stock Analysis

- Norway

- /

- Energy Services

- /

- OB:TGS

There's Reason For Concern Over TGS ASA's (OB:TGS) Massive 28% Price Jump

TGS ASA (OB:TGS) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 33% in the last twelve months.

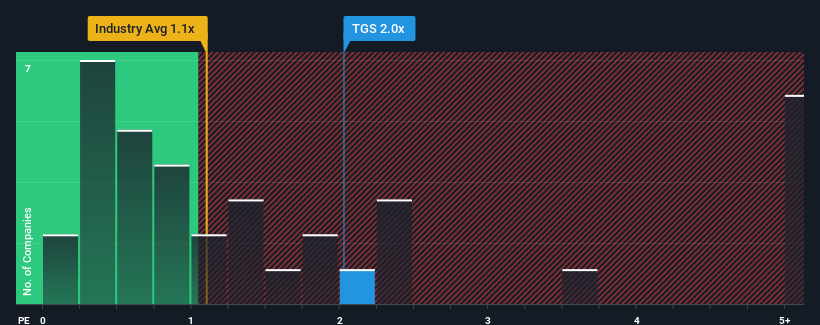

Since its price has surged higher, when almost half of the companies in Norway's Energy Services industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider TGS as a stock probably not worth researching with its 2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for TGS

How Has TGS Performed Recently?

TGS could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think TGS' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For TGS?

In order to justify its P/S ratio, TGS would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. This was backed up an excellent period prior to see revenue up by 121% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 8.7% per year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 12% per annum, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that TGS' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does TGS' P/S Mean For Investors?

The large bounce in TGS' shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see TGS trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 4 warning signs for TGS that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether TGS is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About OB:TGS

TGS

TGS ASA provides geoscience data services to the oil and gas industry worldwide.

Excellent balance sheet with reasonable growth potential.