Stock Analysis

- India

- /

- Specialty Stores

- /

- NSEI:SENCO

There's Reason For Concern Over Senco Gold Limited's (NSE:SENCO) Massive 30% Price Jump

Senco Gold Limited (NSE:SENCO) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

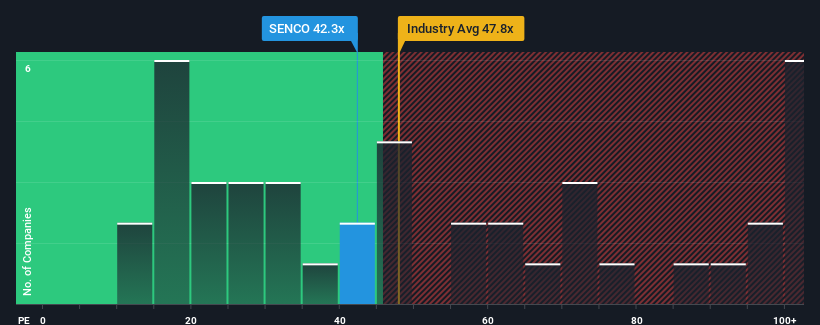

Following the firm bounce in price, Senco Gold may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 42.3x, since almost half of all companies in India have P/E ratios under 31x and even P/E's lower than 17x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings growth that's inferior to most other companies of late, Senco Gold has been relatively sluggish. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Senco Gold

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Senco Gold's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a decent 7.4% gain to the company's bottom line. Pleasingly, EPS has also lifted 143% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 19% as estimated by the dual analysts watching the company. That's shaping up to be materially lower than the 24% growth forecast for the broader market.

With this information, we find it concerning that Senco Gold is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

The large bounce in Senco Gold's shares has lifted the company's P/E to a fairly high level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Senco Gold currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with Senco Gold.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Senco Gold is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SENCO

Senco Gold

Senco Gold Limited manufactures and trades in jewelry and articles made of gold, silver, platinum, and other precious and semi-precious stones in India.

Reasonable growth potential with adequate balance sheet.