Stock Analysis

- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:MRO

There's Reason For Concern Over Melrose Industries PLC's (LON:MRO) Price

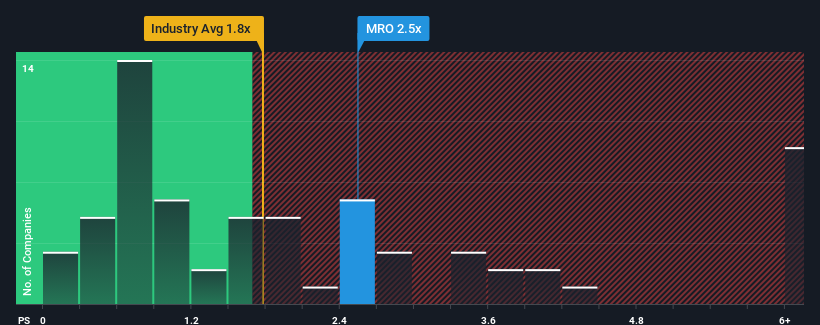

Melrose Industries PLC's (LON:MRO) price-to-sales (or "P/S") ratio of 2.5x may not look like an appealing investment opportunity when you consider close to half the companies in the Aerospace & Defense industry in the United Kingdom have P/S ratios below 1.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Melrose Industries

How Melrose Industries Has Been Performing

Recent times haven't been great for Melrose Industries as its revenue has been falling quicker than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Melrose Industries.How Is Melrose Industries' Revenue Growth Trending?

In order to justify its P/S ratio, Melrose Industries would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 56% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 53% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 8.9% each year as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 10% each year, which is not materially different.

With this in consideration, we find it intriguing that Melrose Industries' P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Melrose Industries' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given Melrose Industries' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about this 1 warning sign we've spotted with Melrose Industries.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Melrose Industries is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About LSE:MRO

Melrose Industries

Melrose Industries PLC, together with its subsidiaries, provides aerospace components and systems to civil and defence markets in the United Kingdom, rest of Europe, North America, and internationally.

Reasonable growth potential and slightly overvalued.