Stock Analysis

- Brazil

- /

- Real Estate

- /

- BOVESPA:IGTI3

There's Reason For Concern Over Iguatemi S.A.'s (BVMF:IGTI3) Price

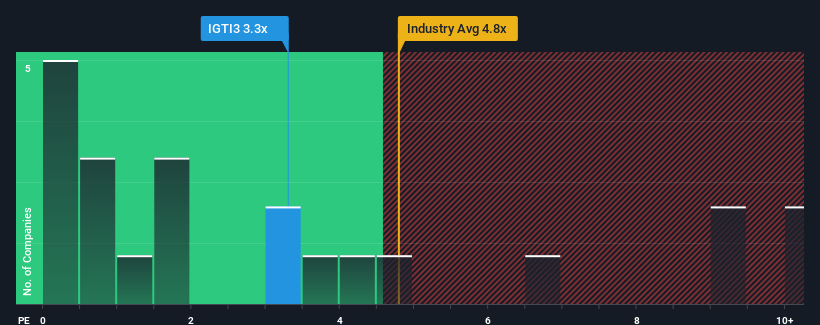

When you see that almost half of the companies in the Real Estate industry in Brazil have price-to-sales ratios (or "P/S") below 2.5x, Iguatemi S.A. (BVMF:IGTI3) looks to be giving off some sell signals with its 3.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Iguatemi

What Does Iguatemi's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Iguatemi has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Iguatemi's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Iguatemi's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. The latest three year period has also seen an excellent 67% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 7.7% each year as estimated by the nine analysts watching the company. With the industry predicted to deliver 6.8% growth each year, the company is positioned for a comparable revenue result.

With this information, we find it interesting that Iguatemi is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Iguatemi currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Iguatemi (1 is a bit concerning) you should be aware of.

If these risks are making you reconsider your opinion on Iguatemi, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Iguatemi is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About BOVESPA:IGTI3

Solid track record with reasonable growth potential.