Stock Analysis

- Brazil

- /

- Healthcare Services

- /

- BOVESPA:FLRY3

The Price Is Right For Fleury S.A. (BVMF:FLRY3)

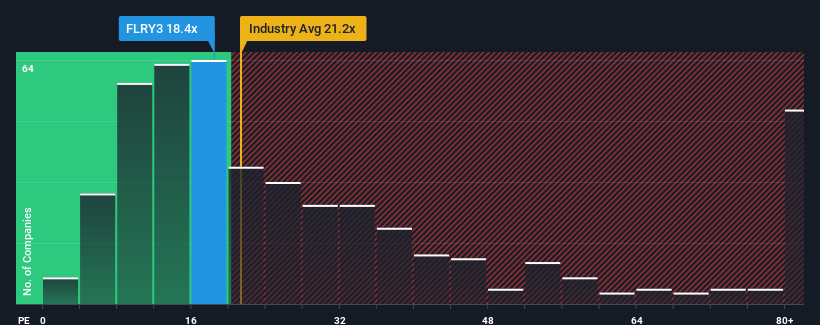

Fleury S.A.'s (BVMF:FLRY3) price-to-earnings (or "P/E") ratio of 18.4x might make it look like a strong sell right now compared to the market in Brazil, where around half of the companies have P/E ratios below 10x and even P/E's below 7x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Fleury's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Fleury

How Is Fleury's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Fleury's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 8.3%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 18% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 16% per year, which is noticeably less attractive.

With this information, we can see why Fleury is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Fleury's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Fleury maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for Fleury that you need to take into consideration.

If these risks are making you reconsider your opinion on Fleury, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Fleury is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About BOVESPA:FLRY3

Fleury

Fleury S.A., together with its subsidiaries, provides medical services in the diagnostic, treatment, clinical analysis, health management, medical care, orthopedics, and ophthalmology areas in Brazil.

Good value with reasonable growth potential and pays a dividend.