Stock Analysis

- Taiwan

- /

- Renewable Energy

- /

- TWSE:6873

The Market Lifts HD Renewable Energy Co., Ltd. (TWSE:6873) Shares 27% But It Can Do More

Despite an already strong run, HD Renewable Energy Co., Ltd. (TWSE:6873) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 33% in the last year.

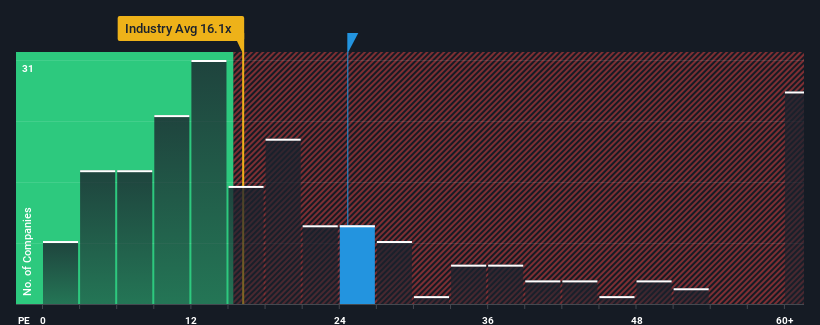

In spite of the firm bounce in price, it's still not a stretch to say that HD Renewable Energy's price-to-earnings (or "P/E") ratio of 24.6x right now seems quite "middle-of-the-road" compared to the market in Taiwan, where the median P/E ratio is around 23x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

HD Renewable Energy certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for HD Renewable Energy

What Are Growth Metrics Telling Us About The P/E?

HD Renewable Energy's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow EPS by an impressive 110% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 68% over the next year. Meanwhile, the rest of the market is forecast to only expand by 26%, which is noticeably less attractive.

In light of this, it's curious that HD Renewable Energy's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On HD Renewable Energy's P/E

HD Renewable Energy appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of HD Renewable Energy's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - HD Renewable Energy has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

You might be able to find a better investment than HD Renewable Energy. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether HD Renewable Energy is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About TWSE:6873

HD Renewable Energy

HD Renewable Energy Co., LTD. engages in the generation and sale of electricity in Taiwan.

Exceptional growth potential and good value.