Stock Analysis

- France

- /

- Communications

- /

- ENXTPA:ATEME

The Market Lifts ATEME SA (EPA:ATEME) Shares 33% But It Can Do More

ATEME SA (EPA:ATEME) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

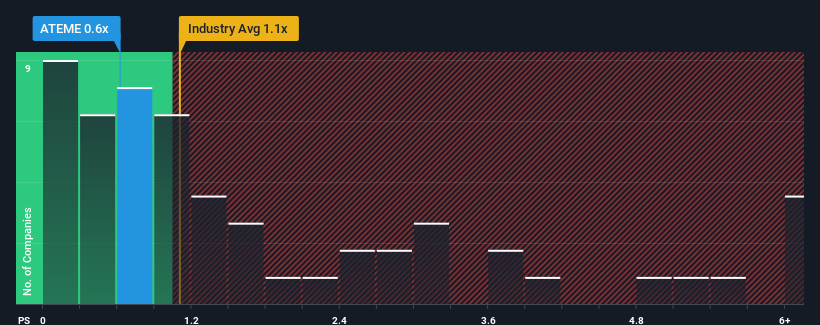

Even after such a large jump in price, it's still not a stretch to say that ATEME's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Communications industry in France, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for ATEME

How Has ATEME Performed Recently?

ATEME certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think ATEME's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For ATEME?

The only time you'd be comfortable seeing a P/S like ATEME's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. The latest three year period has also seen an excellent 43% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 10.0% as estimated by the sole analyst watching the company. That's shaping up to be materially higher than the 0.7% growth forecast for the broader industry.

With this information, we find it interesting that ATEME is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does ATEME's P/S Mean For Investors?

ATEME's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that ATEME currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for ATEME (1 shouldn't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on ATEME, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether ATEME is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ATEME

ATEME

ATEME SA, together with its subsidiaries, provides electronic and computer devices and instruments worldwide.

Moderate growth potential and slightly overvalued.