Stock Analysis

- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A200710

The 12% return this week takes ADTechnologyLtd's (KOSDAQ:200710) shareholders five-year gains to 163%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. One great example is ADTechnology Co.,Ltd. (KOSDAQ:200710) which saw its share price drive 134% higher over five years. It's also good to see the share price up 55% over the last quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

The past week has proven to be lucrative for ADTechnologyLtd investors, so let's see if fundamentals drove the company's five-year performance.

See our latest analysis for ADTechnologyLtd

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

ADTechnologyLtd's earnings per share are down 37% per year, despite strong share price performance over five years.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

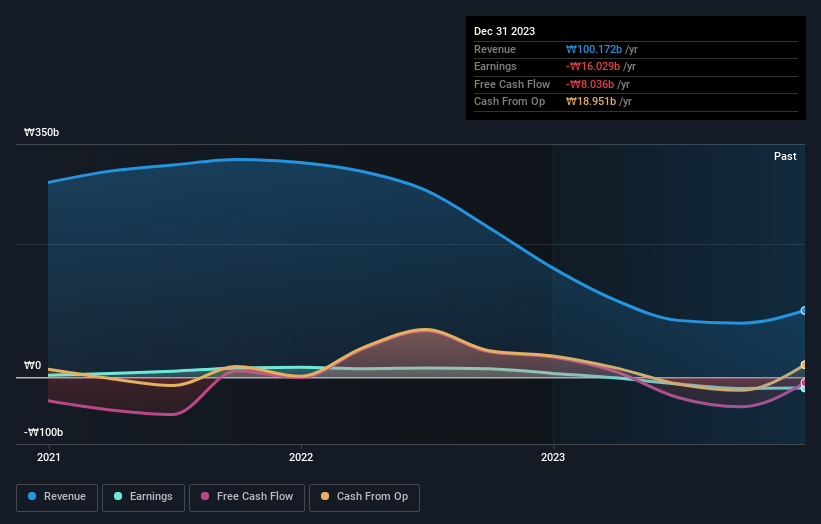

It is not great to see that revenue has dropped by 4.1% per year over five years. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between ADTechnologyLtd's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. ADTechnologyLtd's TSR of 163% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that ADTechnologyLtd shareholders have received a total shareholder return of 112% over one year. That gain is better than the annual TSR over five years, which is 21%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand ADTechnologyLtd better, we need to consider many other factors. For instance, we've identified 2 warning signs for ADTechnologyLtd (1 is concerning) that you should be aware of.

Of course ADTechnologyLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether ADTechnologyLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About KOSDAQ:A200710

ADTechnologyLtd

ADTechnology Co.,Ltd. designs and develops semiconductor devices in South Korea.

High growth potential with adequate balance sheet.