Stock Analysis

- Austria

- /

- Electrical

- /

- WBAG:CLEN

Take Care Before Jumping Onto Cleen Energy AG (VIE:CLEN) Even Though It's 49% Cheaper

To the annoyance of some shareholders, Cleen Energy AG (VIE:CLEN) shares are down a considerable 49% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 91% share price decline.

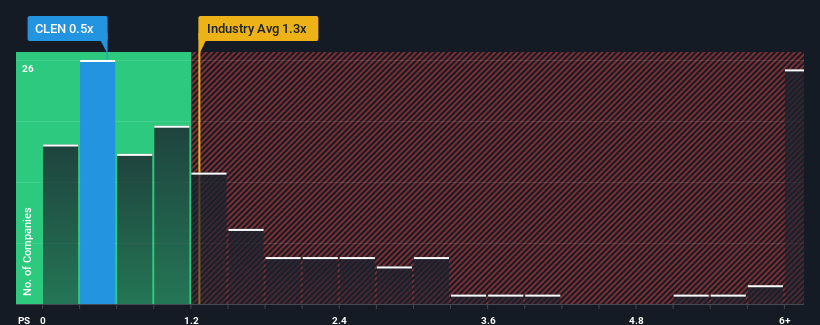

After such a large drop in price, given about half the companies operating in Austria's Electrical industry have price-to-sales ratios (or "P/S") above 1.3x, you may consider Cleen Energy as an attractive investment with its 0.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Cleen Energy

How Has Cleen Energy Performed Recently?

With revenue growth that's exceedingly strong of late, Cleen Energy has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Cleen Energy will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Cleen Energy, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Cleen Energy's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Cleen Energy's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 190% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 8.1% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Cleen Energy's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Cleen Energy's P/S

The southerly movements of Cleen Energy's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Cleen Energy currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Before you settle on your opinion, we've discovered 6 warning signs for Cleen Energy that you should be aware of.

If these risks are making you reconsider your opinion on Cleen Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Cleen Energy is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:CLEN

Cleen Energy

Cleen Energy AG engages in the provision of renewable technologies in German-speaking countries internationally.

Imperfect balance sheet and overvalued.