Stock Analysis

- Switzerland

- /

- Medical Equipment

- /

- SWX:STMN

Straumann Holding AG's (VTX:STMN) P/S Still Appears To Be Reasonable

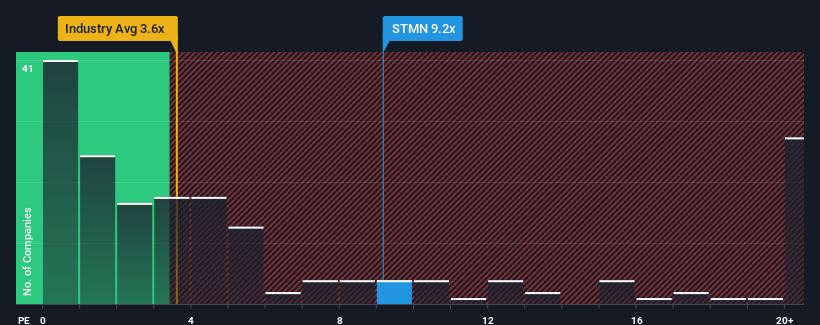

With a price-to-sales (or "P/S") ratio of 9.2x Straumann Holding AG (VTX:STMN) may be sending very bearish signals at the moment, given that almost half of all the Medical Equipment companies in Switzerland have P/S ratios under 4.2x and even P/S lower than 1.6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Straumann Holding

What Does Straumann Holding's Recent Performance Look Like?

Recent revenue growth for Straumann Holding has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Straumann Holding's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Straumann Holding?

Straumann Holding's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a decent 3.9% gain to the company's revenues. Pleasingly, revenue has also lifted 69% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 10% per annum during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 7.5% per annum growth forecast for the broader industry.

With this information, we can see why Straumann Holding is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Straumann Holding's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Straumann Holding maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Medical Equipment industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Straumann Holding that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Straumann Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About SWX:STMN

Straumann Holding

Straumann Holding AG provides tooth replacement and orthodontic solutions worldwide.

Flawless balance sheet with high growth potential.