Stock Analysis

- Australia

- /

- Medical Equipment

- /

- ASX:SOM

SomnoMed Limited (ASX:SOM) Stock's 43% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the SomnoMed Limited (ASX:SOM) share price has dived 43% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 78% share price decline.

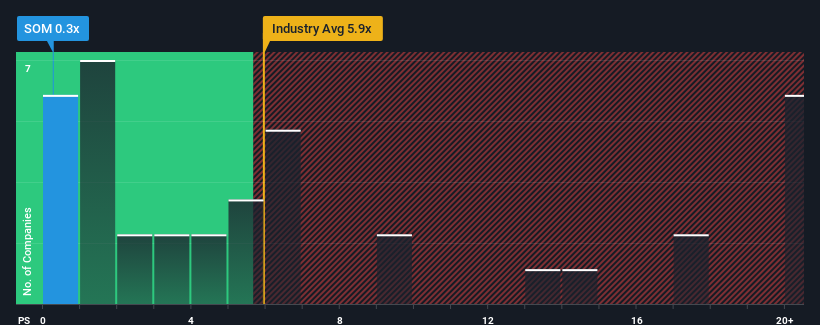

Since its price has dipped substantially, SomnoMed's price-to-sales (or "P/S") ratio of 0.3x might make it look like a strong buy right now compared to the wider Medical Equipment industry in Australia, where around half of the companies have P/S ratios above 5.9x and even P/S above 11x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for SomnoMed

What Does SomnoMed's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, SomnoMed has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SomnoMed.How Is SomnoMed's Revenue Growth Trending?

In order to justify its P/S ratio, SomnoMed would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. The latest three year period has also seen an excellent 62% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 15% over the next year. That's shaping up to be similar to the 14% growth forecast for the broader industry.

In light of this, it's peculiar that SomnoMed's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Having almost fallen off a cliff, SomnoMed's share price has pulled its P/S way down as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that SomnoMed currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with SomnoMed (at least 2 which are a bit concerning), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether SomnoMed is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ASX:SOM

SomnoMed

SomnoMed Limited, together with its subsidiaries, engages in the production and sale of devices for the oral appliances for the treatment of sleep related disorders in Europe, North America, and the Asia Pacific region.

Excellent balance sheet and fair value.