Stock Analysis

- Australia

- /

- Diversified Financial

- /

- ASX:SOL

Some Shareholders Feeling Restless Over Washington H. Soul Pattinson and Company Limited's (ASX:SOL) P/E Ratio

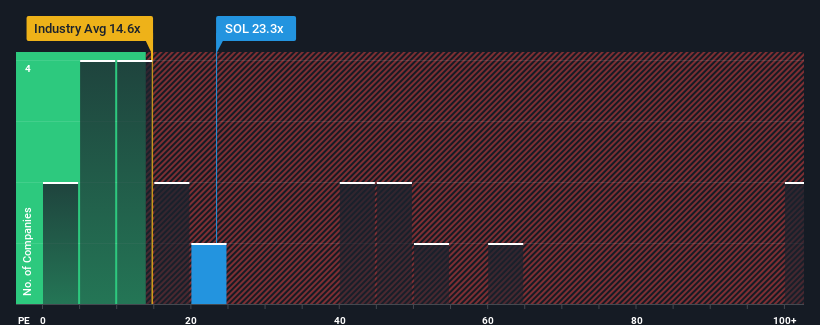

Washington H. Soul Pattinson and Company Limited's (ASX:SOL) price-to-earnings (or "P/E") ratio of 23.3x might make it look like a sell right now compared to the market in Australia, where around half of the companies have P/E ratios below 20x and even P/E's below 11x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times haven't been advantageous for Washington H. Soul Pattinson as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Washington H. Soul Pattinson

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Washington H. Soul Pattinson's is when the company's growth is on track to outshine the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 50%. As a result, earnings from three years ago have also fallen 63% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the two analysts covering the company suggest earnings growth is heading into negative territory, declining 3.9% per year over the next three years. Meanwhile, the broader market is forecast to expand by 17% per annum, which paints a poor picture.

In light of this, it's alarming that Washington H. Soul Pattinson's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Washington H. Soul Pattinson's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Washington H. Soul Pattinson with six simple checks.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're helping make it simple.

Find out whether Washington H. Soul Pattinson is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ASX:SOL

Washington H. Soul Pattinson

Washington H. Soul Pattinson and Company Limited, an investment company, engages in investing various industries and asset classes in Australia.

Excellent balance sheet average dividend payer.