Stock Analysis

- Denmark

- /

- Life Sciences

- /

- CPSE:CHEMM

Some Confidence Is Lacking In ChemoMetec A/S (CPH:CHEMM) As Shares Slide 32%

ChemoMetec A/S (CPH:CHEMM) shareholders won't be pleased to see that the share price has had a very rough month, dropping 32% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 21% share price drop.

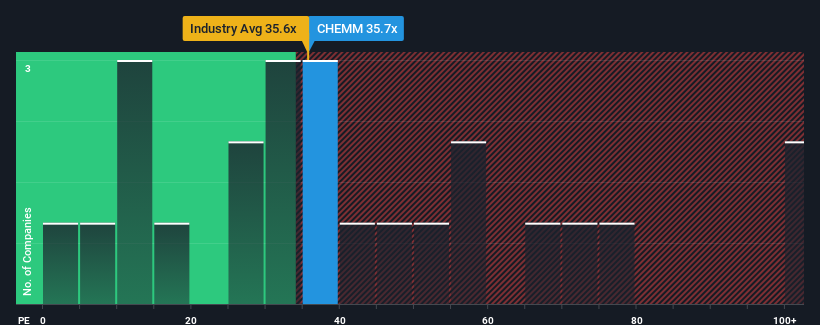

In spite of the heavy fall in price, given close to half the companies in Denmark have price-to-earnings ratios (or "P/E's") below 15x, you may still consider ChemoMetec as a stock to avoid entirely with its 35.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

ChemoMetec has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for ChemoMetec

Is There Enough Growth For ChemoMetec?

The only time you'd be truly comfortable seeing a P/E as steep as ChemoMetec's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. Even so, admirably EPS has lifted 94% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 13% per year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the market is forecast to expand by 16% each year, which is noticeably more attractive.

With this information, we find it concerning that ChemoMetec is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

ChemoMetec's shares may have retreated, but its P/E is still flying high. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of ChemoMetec's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 2 warning signs for ChemoMetec (of which 1 can't be ignored!) you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether ChemoMetec is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About CPSE:CHEMM

ChemoMetec

ChemoMetec A/S engages in the development, production, and sale of analytical equipment for cell counting and analysis the United States, Canada, Europe, and internationally.

Flawless balance sheet with moderate growth potential.