Stock Analysis

Shareholders In DaiwaLtd (TSE:8247) Should Look Beyond Earnings For The Full Story

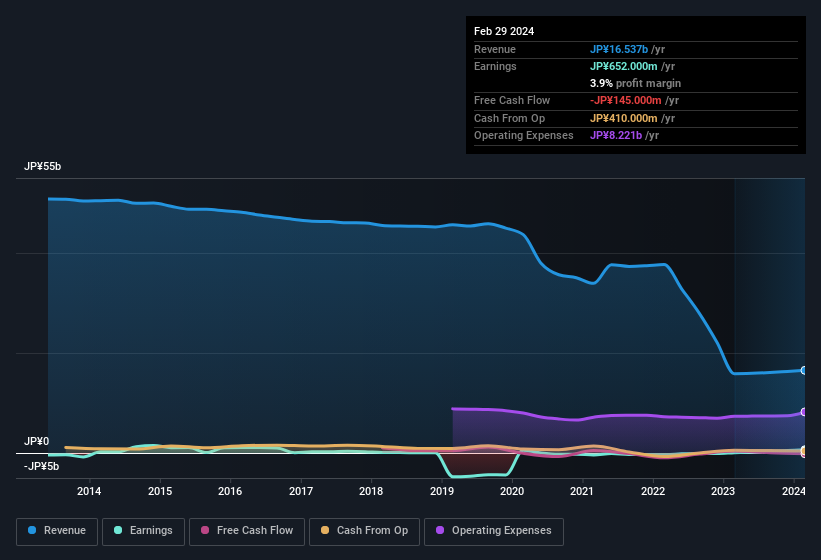

Despite posting strong earnings, Daiwa Co.,Ltd.'s (TSE:8247) stock didn't move much over the last week. We decided to have a deeper look, and we believe that investors might be worried about several concerning factors that we found.

Check out our latest analysis for DaiwaLtd

The Impact Of Unusual Items On Profit

For anyone who wants to understand DaiwaLtd's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from JP¥191m worth of unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. We can see that DaiwaLtd's positive unusual items were quite significant relative to its profit in the year to February 2024. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of DaiwaLtd.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that DaiwaLtd received a tax benefit which contributed JP¥148m to the bottom line. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On DaiwaLtd's Profit Performance

In the last year DaiwaLtd received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated. For all the reasons mentioned above, we think that, at a glance, DaiwaLtd's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For instance, we've identified 3 warning signs for DaiwaLtd (1 doesn't sit too well with us) you should be familiar with.

Our examination of DaiwaLtd has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're helping make it simple.

Find out whether DaiwaLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8247

Proven track record and slightly overvalued.