Stock Analysis

Sequoia Logística e Transportes S.A. (BVMF:SEQL3) Might Not Be As Mispriced As It Looks After Plunging 26%

To the annoyance of some shareholders, Sequoia Logística e Transportes S.A. (BVMF:SEQL3) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 81% share price decline.

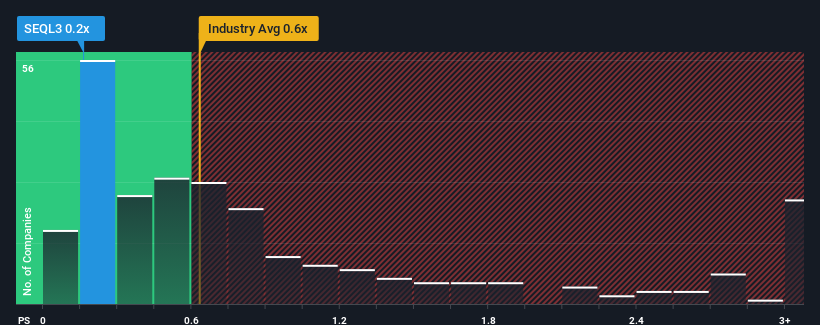

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Sequoia Logística e Transportes' P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Logistics industry in Brazil is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Sequoia Logística e Transportes

How Sequoia Logística e Transportes Has Been Performing

Recent times haven't been great for Sequoia Logística e Transportes as its revenue has been falling quicker than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Sequoia Logística e Transportes' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sequoia Logística e Transportes' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 59%. As a result, revenue from three years ago have also fallen 25% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 182% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 4.7%, which is noticeably less attractive.

In light of this, it's curious that Sequoia Logística e Transportes' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Sequoia Logística e Transportes looks to be in line with the rest of the Logistics industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Sequoia Logística e Transportes currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Sequoia Logística e Transportes (at least 4 which are potentially serious), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Sequoia Logística e Transportes, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Sequoia Logística e Transportes is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:SEQL3

Sequoia Logística e Transportes

Sequoia Logística e Transportes S.A. provides logistics, warehouse, transportation, supply chain, and operation management services.

Slightly overvalued with weak fundamentals.