Stock Analysis

- Japan

- /

- Hospitality

- /

- TSE:3563

Sentiment Still Eluding Food & Life Companies Ltd. (TSE:3563)

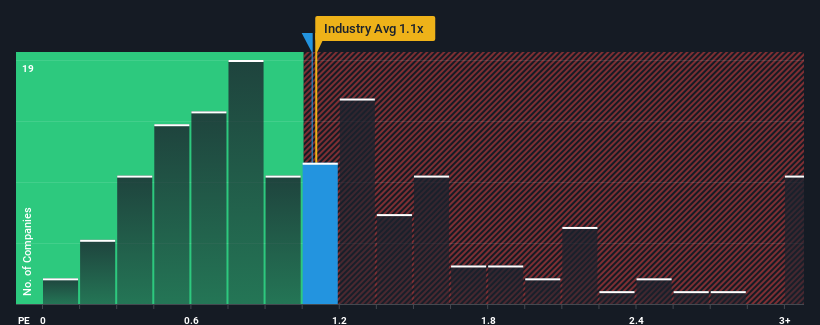

There wouldn't be many who think Food & Life Companies Ltd.'s (TSE:3563) price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S for the Hospitality industry in Japan is very similar. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Food & Life Companies

How Food & Life Companies Has Been Performing

With revenue growth that's inferior to most other companies of late, Food & Life Companies has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Food & Life Companies.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Food & Life Companies' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 53% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 13% per annum over the next three years. That's shaping up to be materially higher than the 8.7% each year growth forecast for the broader industry.

In light of this, it's curious that Food & Life Companies' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Food & Life Companies' P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 2 warning signs for Food & Life Companies that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Food & Life Companies is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About TSE:3563

Food & Life Companies

Food & Life Companies Ltd. operates a chain of Sushi restaurants.

Moderate growth potential with acceptable track record.