Stock Analysis

- United Kingdom

- /

- Software

- /

- LSE:RM.

RM plc (LON:RM.) Surges 32% Yet Its Low P/S Is No Reason For Excitement

RM plc (LON:RM.) shares have had a really impressive month, gaining 32% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.5% over the last year.

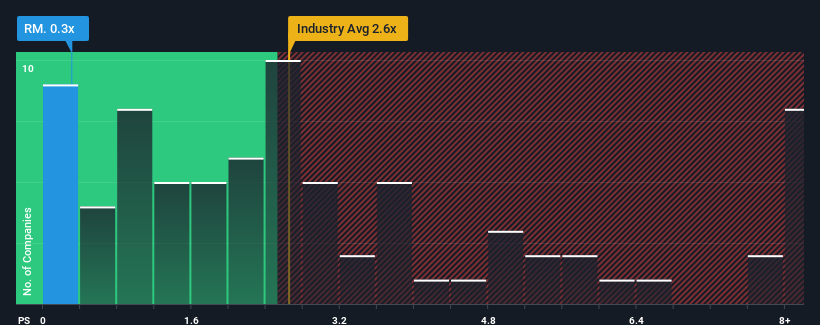

Even after such a large jump in price, RM's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a strong buy right now compared to the wider Software industry in the United Kingdom, where around half of the companies have P/S ratios above 2.6x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for RM

What Does RM's Recent Performance Look Like?

While the industry has experienced revenue growth lately, RM's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on RM will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, RM would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.9%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 0.7% per annum as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 12% each year, which is noticeably more attractive.

In light of this, it's understandable that RM's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From RM's P/S?

RM's recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of RM's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for RM (1 is significant) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether RM is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About LSE:RM.

RM

RM plc supplies products, services, and solutions to educational markets in the United Kingdom, Europe, North America, Asia, the Middle East, and internationally.

Undervalued with reasonable growth potential.