Stock Analysis

- Switzerland

- /

- Machinery

- /

- SWX:INRN

Risks To Shareholder Returns Are Elevated At These Prices For Interroll Holding AG (VTX:INRN)

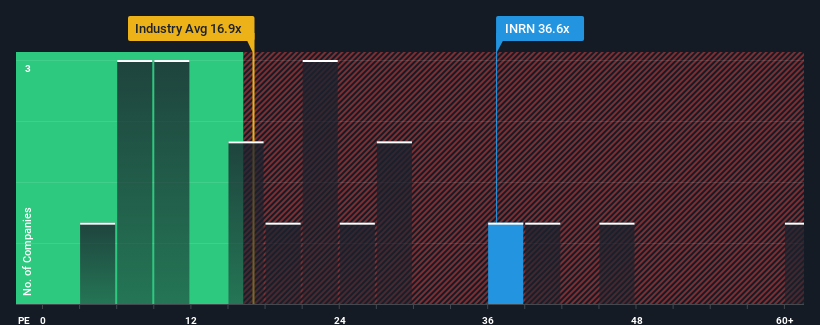

With a price-to-earnings (or "P/E") ratio of 36.6x Interroll Holding AG (VTX:INRN) may be sending very bearish signals at the moment, given that almost half of all companies in Switzerland have P/E ratios under 21x and even P/E's lower than 13x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Interroll Holding could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Interroll Holding

Does Growth Match The High P/E?

In order to justify its P/E ratio, Interroll Holding would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 20%. This means it has also seen a slide in earnings over the longer-term as EPS is down 6.3% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 8.3% per annum over the next three years. With the market predicted to deliver 11% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's alarming that Interroll Holding's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Interroll Holding's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Interroll Holding's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Interroll Holding with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Interroll Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About SWX:INRN

Interroll Holding

Interroll Holding AG provides material handling solutions in Germany, rest of Europe, the Middle East, Africa, the United States, rest of the Americas, China, and rest of the Asia- Pacific.

Flawless balance sheet with moderate growth potential.