Stock Analysis

- United States

- /

- Life Sciences

- /

- NYSE:RVTY

Revvity (NYSE:RVTY) shareholders have lost 26% over 1 year, earnings decline likely the culprit

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Revvity, Inc. (NYSE:RVTY) share price slid 26% over twelve months. That falls noticeably short of the market return of around 23%. Even if shareholders bought some time ago, they wouldn't be particularly happy: the stock is down 25% in three years. The last week also saw the share price slip down another 6.8%. But this could be related to the soft market, which is down about 3.7% in the same period.

After losing 6.8% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Revvity

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

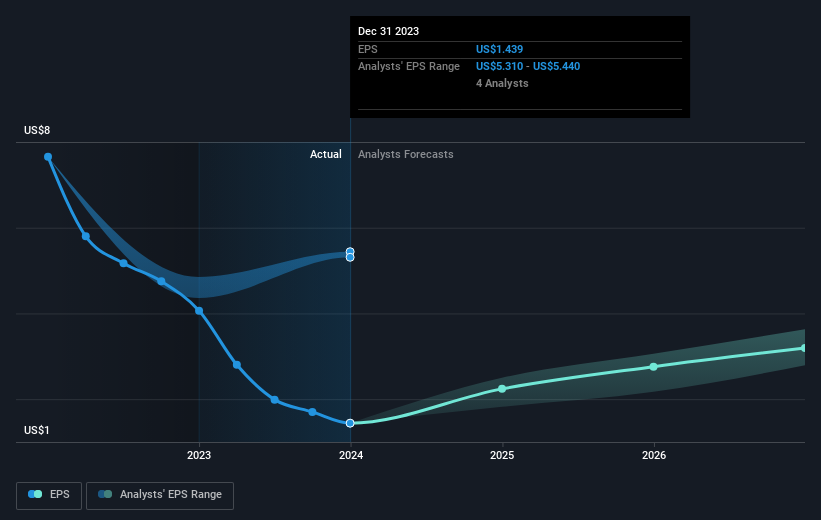

Unhappily, Revvity had to report a 65% decline in EPS over the last year. The share price fall of 26% isn't as bad as the reduction in earnings per share. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult. Indeed, with a P/E ratio of 69.19 there is obviously some real optimism that earnings will bounce back.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Revvity's earnings, revenue and cash flow.

A Different Perspective

Investors in Revvity had a tough year, with a total loss of 26% (including dividends), against a market gain of about 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 1.5%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Revvity is showing 2 warning signs in our investment analysis , you should know about...

We will like Revvity better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Revvity is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RVTY

Revvity

Revvity, Inc. provides health sciences solutions, technologies, and services in the Americas, Europe, and Asia, and internationally.

Adequate balance sheet and fair value.