Stock Analysis

- Saudi Arabia

- /

- Real Estate

- /

- SASE:4230

Revenues Working Against Red Sea International Company's (TADAWUL:4230) Share Price

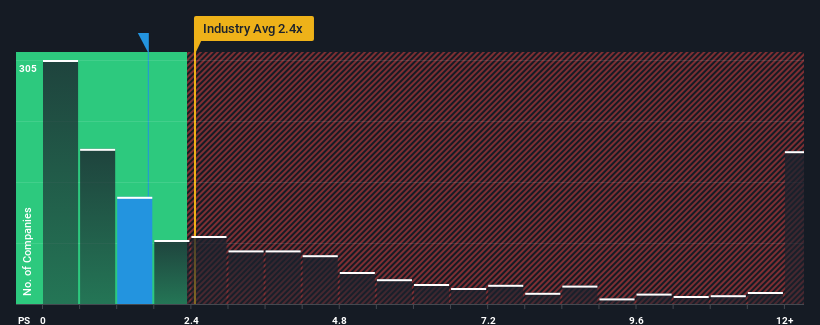

With a price-to-sales (or "P/S") ratio of 1.7x Red Sea International Company (TADAWUL:4230) may be sending very bullish signals at the moment, given that almost half of all the Real Estate companies in Saudi Arabia have P/S ratios greater than 10.2x and even P/S higher than 21x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Red Sea International

How Red Sea International Has Been Performing

Recent times have been quite advantageous for Red Sea International as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Red Sea International's earnings, revenue and cash flow.How Is Red Sea International's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Red Sea International's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. Still, revenue has fallen 20% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

In contrast to the company, the rest of the industry is expected to grow by 11% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why Red Sea International's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Red Sea International revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

You always need to take note of risks, for example - Red Sea International has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Red Sea International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Red Sea International is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4230

Red Sea International

Red Sea International Company offers modular building solutions in Saudi Arabia, the United Arab Emirates, and internationally.

Mediocre balance sheet and slightly overvalued.