Stock Analysis

- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A156100

Revenues Tell The Story For L&K Biomed Ltd. (KOSDAQ:156100)

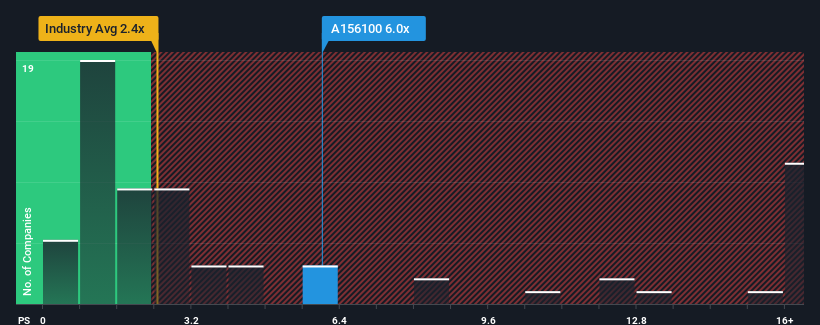

When close to half the companies in the Medical Equipment industry in Korea have price-to-sales ratios (or "P/S") below 2.4x, you may consider L&K Biomed Ltd. (KOSDAQ:156100) as a stock to avoid entirely with its 6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for L&K Biomed

What Does L&K Biomed's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, L&K Biomed has been doing quite well of late. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on L&K Biomed.Is There Enough Revenue Growth Forecasted For L&K Biomed?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like L&K Biomed's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 51%. The strong recent performance means it was also able to grow revenue by 54% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 105% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 24% growth forecast for the broader industry.

With this information, we can see why L&K Biomed is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that L&K Biomed maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Medical Equipment industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - L&K Biomed has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on L&K Biomed, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether L&K Biomed is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About KOSDAQ:A156100

L&K Biomed

L&K Biomed Ltd., a medical company, manufactures and sells spinal implants worldwide.

Exceptional growth potential with excellent balance sheet.