Stock Analysis

- Switzerland

- /

- Medical Equipment

- /

- SWX:MED

Pulling back 9.2% this week, Medartis Holding's VTX:MED) five-year decline in earnings may be coming into investors focus

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Medartis Holding share price has climbed 50% in five years, easily topping the market return of 17% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 21%.

While the stock has fallen 9.2% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Medartis Holding

We don't think that Medartis Holding's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Medartis Holding can boast revenue growth at a rate of 12% per year. That's a pretty good long term growth rate. While the share price has beat the market, compounding at 8% yearly, over five years, there's certainly some potential that the market hasn't fully considered the growth track record. If revenue growth can maintain for long enough, it's likely profits will flow. There's no doubt that it can be difficult to value pre-profit companies.

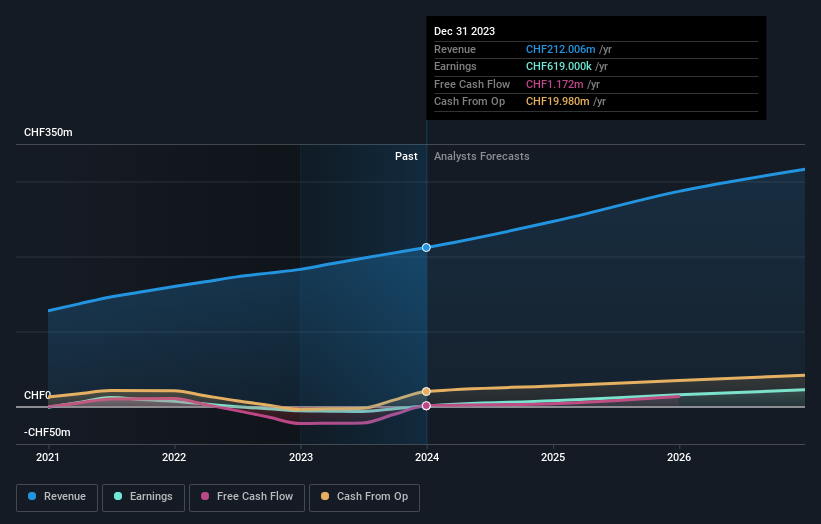

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Medartis Holding has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Medartis Holding

A Different Perspective

It's nice to see that Medartis Holding shareholders have received a total shareholder return of 21% over the last year. That gain is better than the annual TSR over five years, which is 8%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Medartis Holding .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Medartis Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:MED

Medartis Holding

Medartis Holding AG, a medical device company, develops, manufactures, and sells implant solutions worldwide.

Excellent balance sheet and good value.