Stock Analysis

Piippo Oyj (HEL:PIIPPO) Investors Are Less Pessimistic Than Expected

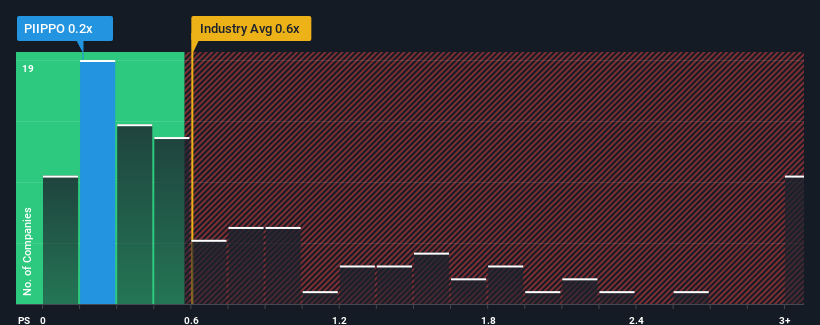

With a median price-to-sales (or "P/S") ratio of close to 0.6x in the Luxury industry in Finland, you could be forgiven for feeling indifferent about Piippo Oyj's (HEL:PIIPPO) P/S ratio of 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Piippo Oyj

What Does Piippo Oyj's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Piippo Oyj's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Piippo Oyj will help you uncover what's on the horizon.How Is Piippo Oyj's Revenue Growth Trending?

In order to justify its P/S ratio, Piippo Oyj would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 12% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 2.3% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 6.7%, which is noticeably more attractive.

With this in mind, we find it intriguing that Piippo Oyj's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Piippo Oyj's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that Piippo Oyj's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Piippo Oyj has 4 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Piippo Oyj is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:PIIPPO

Piippo Oyj

Piippo Oyj develops, manufactures, and sells baling net wraps and baling twines for farmers in Finland.

Fair value with imperfect balance sheet.