Stock Analysis

- Malaysia

- /

- Trade Distributors

- /

- KLSE:PANSAR

Pansar Berhad (KLSE:PANSAR) Has A Pretty Healthy Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Pansar Berhad (KLSE:PANSAR) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Pansar Berhad

How Much Debt Does Pansar Berhad Carry?

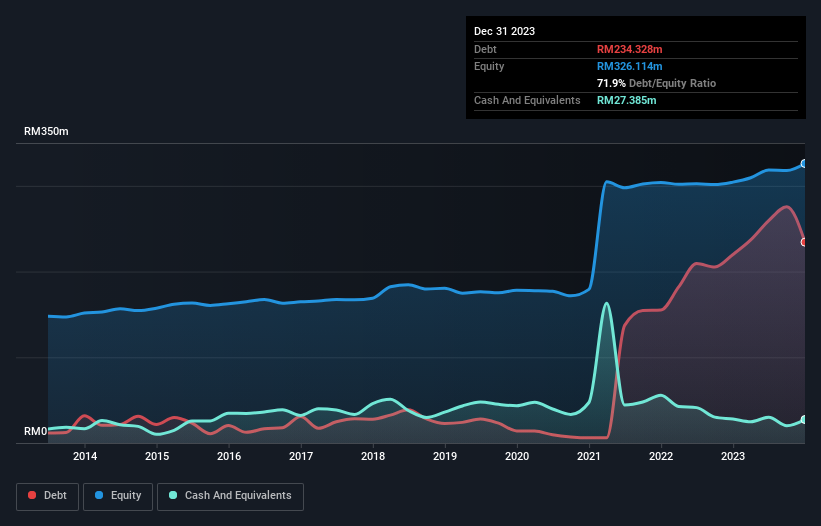

The image below, which you can click on for greater detail, shows that at December 2023 Pansar Berhad had debt of RM234.3m, up from RM220.0m in one year. However, because it has a cash reserve of RM27.4m, its net debt is less, at about RM206.9m.

A Look At Pansar Berhad's Liabilities

Zooming in on the latest balance sheet data, we can see that Pansar Berhad had liabilities of RM365.2m due within 12 months and liabilities of RM21.8m due beyond that. Offsetting these obligations, it had cash of RM27.4m as well as receivables valued at RM463.5m due within 12 months. So it actually has RM104.0m more liquid assets than total liabilities.

This luscious liquidity implies that Pansar Berhad's balance sheet is sturdy like a giant sequoia tree. Having regard to this fact, we think its balance sheet is as strong as an ox.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Pansar Berhad has a debt to EBITDA ratio of 3.9 and its EBIT covered its interest expense 3.4 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. However, it should be some comfort for shareholders to recall that Pansar Berhad actually grew its EBIT by a hefty 166%, over the last 12 months. If that earnings trend continues it will make its debt load much more manageable in the future. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Pansar Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Pansar Berhad burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

The good news is that Pansar Berhad's demonstrated ability to grow its EBIT delights us like a fluffy puppy does a toddler. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. All these things considered, it appears that Pansar Berhad can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Pansar Berhad you should be aware of, and 1 of them is a bit unpleasant.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're helping make it simple.

Find out whether Pansar Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About KLSE:PANSAR

Pansar Berhad

Pansar Berhad sells and distributes building materials, marine and industrial products, agro-engineering equipment and supplies, and electrical and office automation supplies in Malaysia and Singapore.

Solid track record with mediocre balance sheet.