Stock Analysis

- Australia

- /

- Transportation

- /

- ASX:LAU

One ASX Dividend Stock To Embrace And One To Sidestep In April 2024

In the pursuit of reliable dividend stocks on the ASX, it is crucial for investors to consider the stability of dividend payments. While some companies offer attractive and increasing dividends, others have a history of significant cuts, which could signal underlying financial challenges. Understanding these dynamics is key to selecting stocks that not only provide immediate income but also offer long-term investment security.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Auswide Bank (ASX:ABA) | 9.75% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.75% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.04% | ★★★★★☆ |

| Joyce (ASX:JYC) | 6.83% | ★★★★★☆ |

| Korvest (ASX:KOV) | 6.63% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 6.67% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.56% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.58% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 8.05% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.20% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our Top Dividend Stocks screener.

Underneath we present one of the stocks filtered out by our screen and one to sidestep.

One To Reconsider

Viva Energy Group (ASX:VEA)

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: The company operates as an energy provider in Australia, Singapore, and Papua New Guinea with a market capitalization of approximately A$5.72 billion.

Operations: The company generates revenue through three primary segments: Convenience & Mobility (A$10.10 billion), Commercial & Industrial (A$16.64 billion), and Energy & Infrastructure (A$7.32 billion).

Dividend Yield: 3.9%

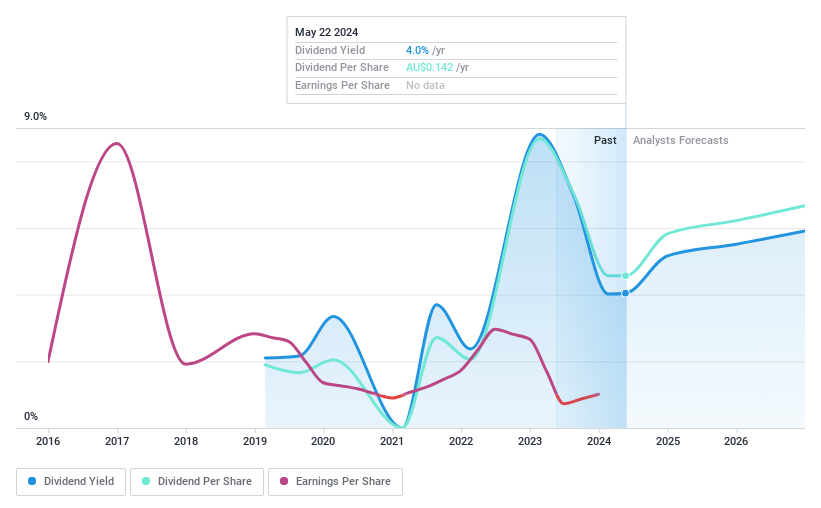

Viva Energy Group's recent financials reveal a significant drop in net income from A$514.3 million to A$3.8 million year-over-year, with earnings per share plummeting from A$0.333 to A$0.002, reflecting underlying business challenges. Despite this, the company declared a dividend of A$0.071, which appears unsustainable given the payout ratio exceeding 6000% and cash payout ratio at 121%. This raises concerns about the reliability and sustainability of future dividends, especially with profit margins also compressing drastically from 1.9% to just 0.01%.

Top Pick

Lindsay Australia (ASX:LAU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lindsay Australia Limited operates in Australia, offering integrated transport, logistics, and rural supply services primarily to sectors such as food processing, food services, fresh produce, and horticulture with a market capitalization of approximately A$328.73 million.

Operations: The company generates revenue through its rural supply services amounting to A$158.73 million and transport services totaling A$571.38 million.

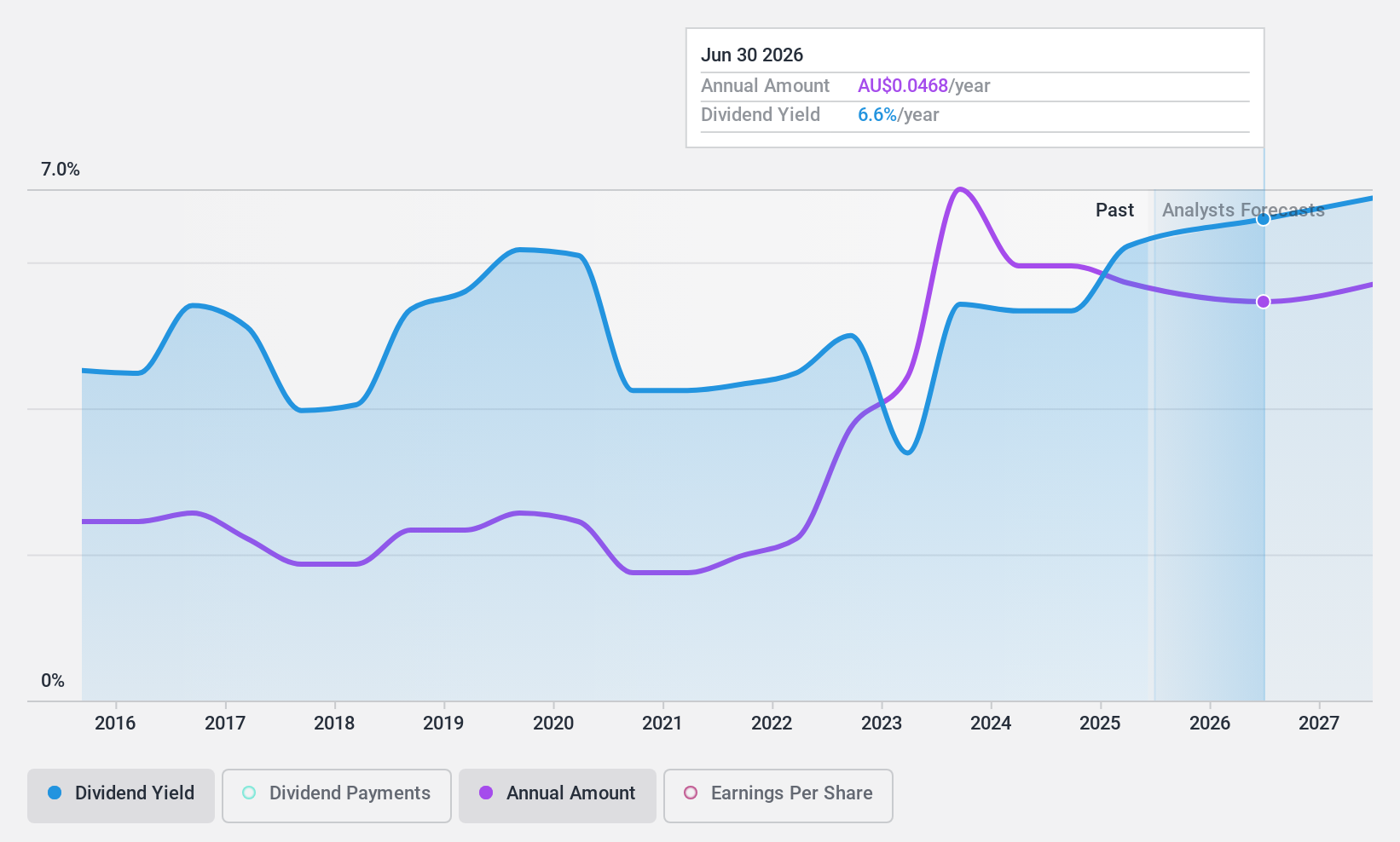

Dividend Yield: 5.7%

Lindsay Australia Limited's recent financial performance shows a positive trajectory with sales increasing to A$417.93 million and net income rising to A$18.08 million, up from the previous year. The company declared a cash dividend of A$0.021, supported by a sustainable payout ratio of 43.7% and cash payout ratio at 38.7%. However, despite these gains, LAU's dividends have shown volatility over the past decade and currently yield 5.69%, which is below the top quartile of Australian dividend payers at 6.15%.

Taking Advantage

- Embark on your investment journey to our 45 Top Dividend Stocks selection here.

- Are any of these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore small companies with big growth potential before they take off.

- Fuel your portfolio with fast-growing stocks poised for rapid expansion.

- Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Lindsay Australia is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St

About ASX:LAU

Lindsay Australia

Lindsay Australia Limited, together with its subsidiaries, provides integrated transport, logistics, and rural supply services to the food processing, food services, fresh produce, and horticulture sectors in Australia.

Outstanding track record, undervalued and pays a dividend.