Stock Analysis

Not Many Are Piling Into T3EX Global Holdings Corp. (TWSE:2636) Just Yet

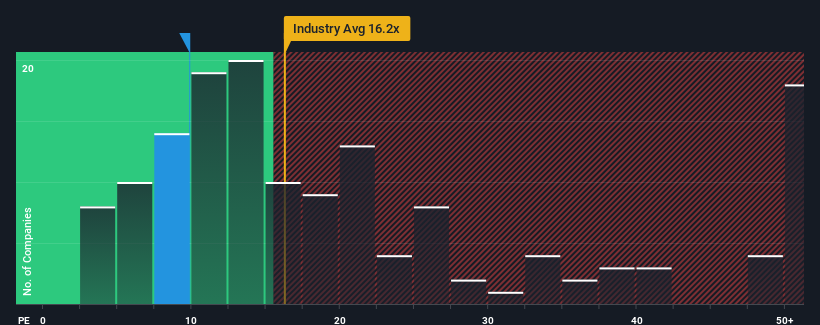

With a price-to-earnings (or "P/E") ratio of 9.9x T3EX Global Holdings Corp. (TWSE:2636) may be sending very bullish signals at the moment, given that almost half of all companies in Taiwan have P/E ratios greater than 24x and even P/E's higher than 41x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For example, consider that T3EX Global Holdings' financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for T3EX Global Holdings

Is There Any Growth For T3EX Global Holdings?

There's an inherent assumption that a company should far underperform the market for P/E ratios like T3EX Global Holdings' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 40%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 128% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that T3EX Global Holdings is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On T3EX Global Holdings' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of T3EX Global Holdings revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for T3EX Global Holdings (of which 1 is significant!) you should know about.

You might be able to find a better investment than T3EX Global Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether T3EX Global Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2636

T3EX Global Holdings

T3EX Global Holdings Corp., an investment holding company, provides integrated logistics services in Taiwan, Hong Kong, Midland China, East Asia, and internationally.

Excellent balance sheet, good value and pays a dividend.