Stock Analysis

- United States

- /

- Auto Components

- /

- NasdaqGM:CREV

Not Many Are Piling Into Carbon Revolution Public Limited Company (NASDAQ:CREV) Stock Yet As It Plummets 26%

To the annoyance of some shareholders, Carbon Revolution Public Limited Company (NASDAQ:CREV) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 85% loss during that time.

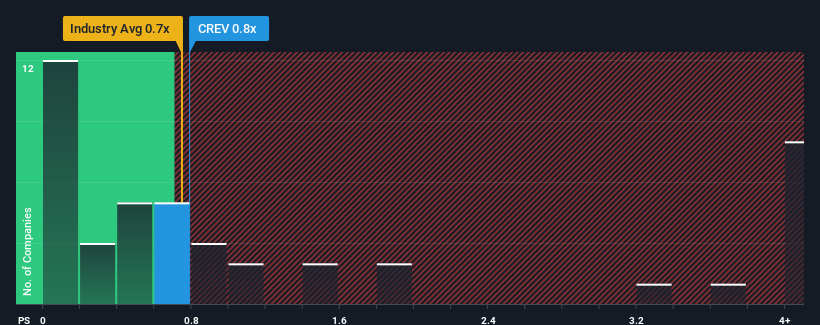

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Carbon Revolution's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in the United States is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Carbon Revolution

What Does Carbon Revolution's Recent Performance Look Like?

Carbon Revolution certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Carbon Revolution will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Carbon Revolution's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 42% last year. The latest three year period has also seen an excellent 59% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 31% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 3.1%, which is noticeably less attractive.

With this information, we find it interesting that Carbon Revolution is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Carbon Revolution's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Carbon Revolution's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 5 warning signs for Carbon Revolution (3 don't sit too well with us!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Carbon Revolution is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NasdaqGM:CREV

Carbon Revolution

Carbon Revolution Public Limited Company manufactures and sells carbon fibre wheels to original equipment vehicle manufacturers for the automotive industry worldwide.

Slightly overvalued with limited growth.