Stock Analysis

- South Korea

- /

- Entertainment

- /

- KOSE:A036570

Ncsoft (KRX:036570) stock falls 6.9% in past week as three-year earnings and shareholder returns continue downward trend

As an investor, mistakes are inevitable. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of Ncsoft Corporation (KRX:036570) investors who have held the stock for three years as it declined a whopping 81%. That would be a disturbing experience. And over the last year the share price fell 54%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 19% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

After losing 6.9% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Ncsoft

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

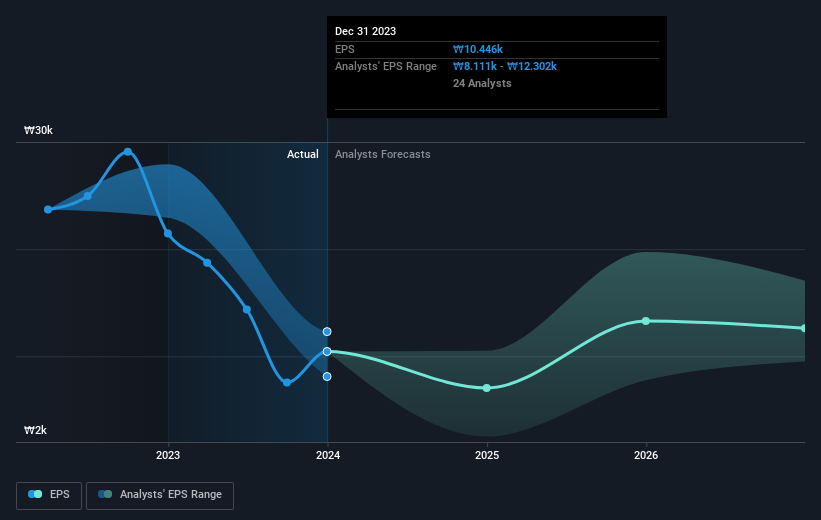

Ncsoft saw its EPS decline at a compound rate of 28% per year, over the last three years. This reduction in EPS is slower than the 42% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Ncsoft's earnings, revenue and cash flow.

A Different Perspective

Investors in Ncsoft had a tough year, with a total loss of 53% (including dividends), against a market gain of about 5.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Ncsoft better, we need to consider many other factors. Take risks, for example - Ncsoft has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Ncsoft is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About KOSE:A036570

Excellent balance sheet and good value.