Stock Analysis

- Hong Kong

- /

- Electrical

- /

- SEHK:1597

More Unpleasant Surprises Could Be In Store For China Nature Energy Technology Holdings Limited's (HKG:1597) Shares After Tumbling 29%

The China Nature Energy Technology Holdings Limited (HKG:1597) share price has fared very poorly over the last month, falling by a substantial 29%. Still, a bad month hasn't completely ruined the past year with the stock gaining 66%, which is great even in a bull market.

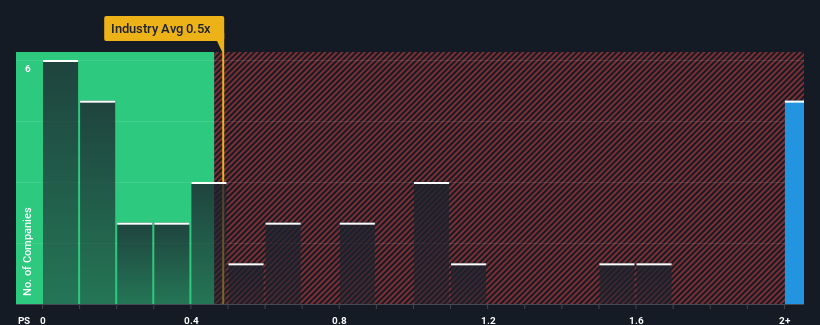

In spite of the heavy fall in price, you could still be forgiven for thinking China Nature Energy Technology Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.4x, considering almost half the companies in Hong Kong's Electrical industry have P/S ratios below 0.5x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for China Nature Energy Technology Holdings

How Has China Nature Energy Technology Holdings Performed Recently?

The revenue growth achieved at China Nature Energy Technology Holdings over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for China Nature Energy Technology Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like China Nature Energy Technology Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 16% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 18% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that China Nature Energy Technology Holdings is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

A significant share price dive has done very little to deflate China Nature Energy Technology Holdings' very lofty P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that China Nature Energy Technology Holdings currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Plus, you should also learn about this 1 warning sign we've spotted with China Nature Energy Technology Holdings.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether China Nature Energy Technology Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About SEHK:1597

China Nature Energy Technology Holdings

China Nature Energy Technology Holdings Limited, an investment holding company, engages in the research and development, integration, manufacturing, and sales of pitch control systems and related components in the People's Republic of China.

Excellent balance sheet with weak fundamentals.