Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqGS:CRBU

More Unpleasant Surprises Could Be In Store For Caribou Biosciences, Inc.'s (NASDAQ:CRBU) Shares After Tumbling 25%

Caribou Biosciences, Inc. (NASDAQ:CRBU) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Longer-term shareholders would now have taken a real hit with the stock declining 8.4% in the last year.

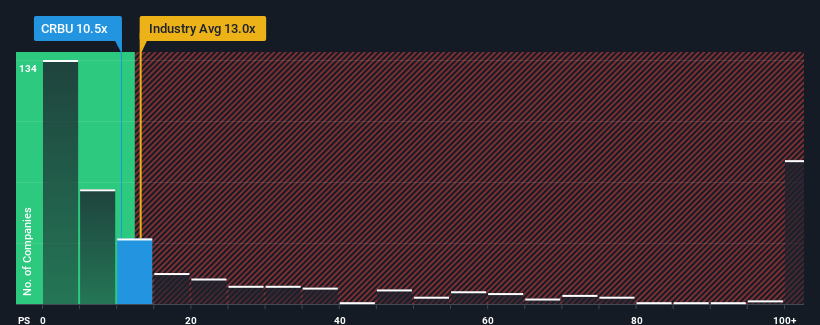

Even after such a large drop in price, it's still not a stretch to say that Caribou Biosciences' price-to-sales (or "P/S") ratio of 10.5x right now seems quite "middle-of-the-road" compared to the Biotechs industry in the United States, where the median P/S ratio is around 13x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Caribou Biosciences

What Does Caribou Biosciences' P/S Mean For Shareholders?

Caribou Biosciences could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Caribou Biosciences.What Are Revenue Growth Metrics Telling Us About The P/S?

Caribou Biosciences' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 149%. The strong recent performance means it was also able to grow revenue by 179% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue growth is heading into negative territory, declining 0.8% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 165% per year.

With this in consideration, we think it doesn't make sense that Caribou Biosciences' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Caribou Biosciences' P/S

Following Caribou Biosciences' share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears that Caribou Biosciences currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Caribou Biosciences (of which 1 doesn't sit too well with us!) you should know about.

If you're unsure about the strength of Caribou Biosciences' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Caribou Biosciences is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NasdaqGS:CRBU

Caribou Biosciences

Caribou Biosciences, Inc., a clinical-stage biopharmaceutical company, engages in the development of genome-edited allogeneic cell therapies for the treatment of hematologic malignancies in the United States and internationally.

Flawless balance sheet and slightly overvalued.