Stock Analysis

- Sweden

- /

- Interactive Media and Services

- /

- OM:MOBA

M.O.B.A. Network AB (publ) (STO:MOBA) Stock Rockets 33% As Investors Are Less Pessimistic Than Expected

M.O.B.A. Network AB (publ) (STO:MOBA) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

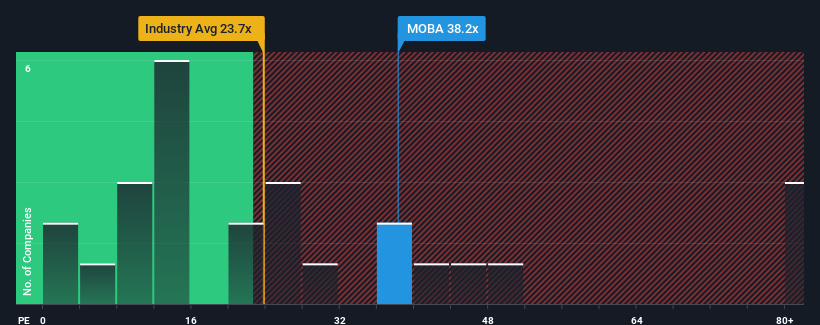

Following the firm bounce in price, M.O.B.A. Network may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 38.2x, since almost half of all companies in Sweden have P/E ratios under 21x and even P/E's lower than 13x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For example, consider that M.O.B.A. Network's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for M.O.B.A. Network

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as M.O.B.A. Network's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 65% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 28% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 21% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that M.O.B.A. Network is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On M.O.B.A. Network's P/E

M.O.B.A. Network's P/E is flying high just like its stock has during the last month. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of M.O.B.A. Network revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 5 warning signs for M.O.B.A. Network (of which 2 are a bit unpleasant!) you should know about.

Of course, you might also be able to find a better stock than M.O.B.A. Network. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether M.O.B.A. Network is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:MOBA

M.O.B.A. Network

M.O.B.A. Network AB (publ) owns and operates various gaming communities to gaming fans to craft strategies and sharing ideas with other players.

High growth potential and overvalued.