Stock Analysis

Messer Tehnogas AD (BELEX:TGAS) shareholders have had their patience rewarded with a 25% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 50%.

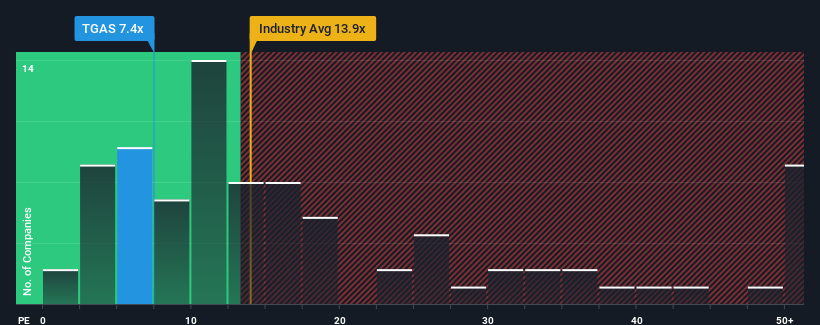

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Messer Tehnogas AD's P/E ratio of 7.4x, since the median price-to-earnings (or "P/E") ratio in Serbia is also close to 7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at Messer Tehnogas AD over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Messer Tehnogas AD

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Messer Tehnogas AD's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 40% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Comparing that to the market, which is predicted to deliver 17% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's curious that Messer Tehnogas AD's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Key Takeaway

Messer Tehnogas AD appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Messer Tehnogas AD revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Messer Tehnogas AD that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Messer Tehnogas AD is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About BELEX:TGAS

Messer Tehnogas AD

Messer Tehnogas AD engages in the production and marketing of industrial, medical, and special gases.

Excellent balance sheet and slightly overvalued.