Stock Analysis

- Hong Kong

- /

- Construction

- /

- SEHK:2295

Maxicity Holdings Limited's (HKG:2295) Popularity With Investors Under Threat As Stock Sinks 29%

To the annoyance of some shareholders, Maxicity Holdings Limited (HKG:2295) shares are down a considerable 29% in the last month, which continues a horrid run for the company. Looking at the bigger picture, even after this poor month the stock is up 61% in the last year.

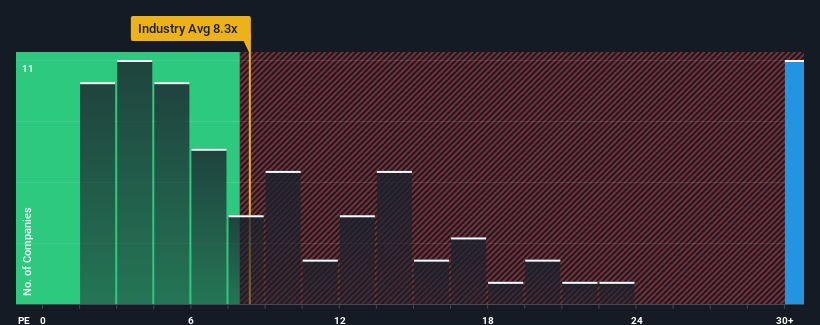

Although its price has dipped substantially, Maxicity Holdings may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 61.1x, since almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For example, consider that Maxicity Holdings' financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Maxicity Holdings

How Is Maxicity Holdings' Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Maxicity Holdings' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.7%. This means it has also seen a slide in earnings over the longer-term as EPS is down 65% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 21% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's alarming that Maxicity Holdings' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

What We Can Learn From Maxicity Holdings' P/E?

Even after such a strong price drop, Maxicity Holdings' P/E still exceeds the rest of the market significantly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Maxicity Holdings currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 1 warning sign for Maxicity Holdings that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Maxicity Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2295

Maxicity Holdings

Maxicity Holdings Limited, an investment holding company, operates as a slope works contractor in Hong Kong.

Flawless balance sheet and overvalued.